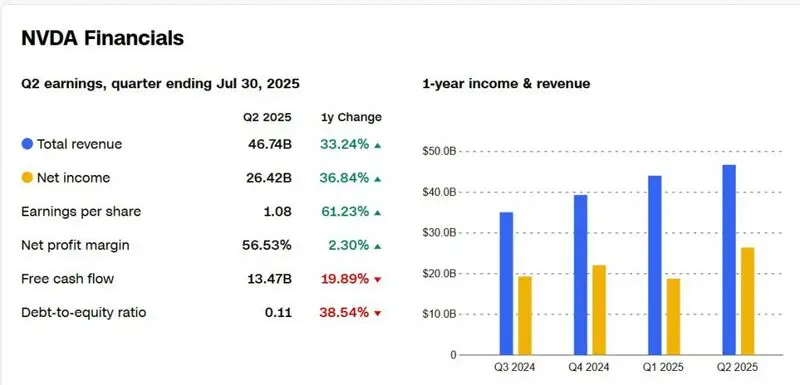

Leading GPU manufacturer Nvidia is trading below the $200 level in October. NVDA opened Tuesday’s bell at $185 and is mostly trading sideways in the charts. Financial strategists have given a ‘buy’ call, urging investors to take an entry position below the $200 mark. The bullish call comes after the chip giant’s revenue surged by 33.24% compared to last year. The Nvidia stock has received bullish projections from CNN Business analysts.

Also Read: Opendoor (OPEN) Stock Up 15%: $15 Next Stop?

Nvidia Stock Could Rise 110%, Projects CNN Business Analysts

Nvidia’s net income has a spike of 36.84% year-on-year, with earnings per share climbing to 61.23%. The company’s net profit margin has increased by 2.30% despite facing challenges due to Trump’s tariffs and trade wars. When the dust settles, Nvidia stock could be a prime bet, rewarding investors who purchased the dips.

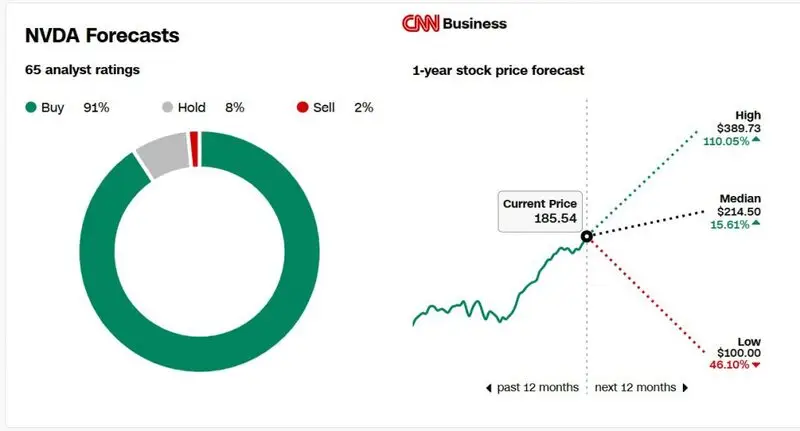

65 financial analysts from CNN Business provided their forecast on NVDA this month. 91% of the analysts gave Nvidia stock a buy call, while 8% of them gave ‘hold’. Only 2% of the analysts were bearish on NVDA and urged investors to sell. The majority of the analysts are in the money for NVDA, indicating that it could double in price next.

Also Read: Netflix Plunges Another 9% After Musk’s Boycott Shaves $25B Off Market Cap

Price Target and Timeline For the 110% Rise

CNN Business analysts project that Nvidia stock could reach a high of $389 in 2026. That’s an uptick and return on investment (ROI) of approximately 110% from its current price of $185. Therefore, an investment of $1,000 could turn into $2,100 in 2026 if the forecast turns out to be accurate.

The average trading price of NVDA next year is $214.50, according to the prediction. That’s a return of around 15.61% and a $1,000 investment could turn $1,156. On the downside, if the markets turn bearish, Nvidia stock could plummet to the $100 level. The downside is much riskier as it could erase close to 47% of its current price.