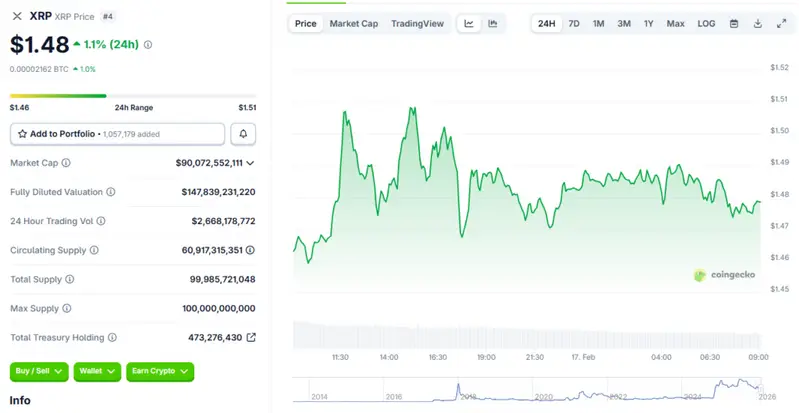

XRP CNBC coverage from January 2026 put the token at the center of mainstream financial media, and the story has only picked up more weight since. As of February 17, 2026, XRP is trading at around $1.48, holding the #4 spot by market cap with a market capitalization of roughly $90.52 billion and a 24-hour trading volume of $2.92 billion. It is up about 1.7% on the day — a modest move, but the broader XRP price surge in 2026 that CNBC first spotlighted back in January is still very much the backdrop. Back then, Power Lunch host Brian Sullivan stated:

“The hottest crypto trade of the year is not Bitcoin, it is not Ether, it is XRP.”— Brian Sullivan, CNBC Power Lunch

At the time, XRP had gained 24% since the start of the year, far outpacing Bitcoin’s 5.5% and Ethereum’s 9.7%. That XRP CNBC breakout in 2026 also briefly pushed it past BNB into third place by market cap before the broader market cooled somewhat into February.

Also Read: XRP Panic Selling Surges: Should You Follow Despite CEO Assurance?

ETF Inflows Drive XRP’s Early 2026 Momentum

Institutions Were Buying Before the Hype

The XRP CNBC coverage didn’t appear out of thin air, and the numbers behind it are also worth looking at closely. Spot XRP ETFs launched in late 2025 had already pulled in $1.37 billion in cumulative inflows by January 2026 — the second-fastest growth rate for any crypto ETF product after Bitcoin — and had not recorded a single day of net outflows during that run. CNBC reporter Mackenzie Sigalos explained what had actually been happening in the weeks before the rally became a headline:

“During the doldrums of Q4, you actually saw a lot of people piling into those XRP ETFs, which is the exact opposite of what happens with the spot Bitcoin and Ether ETFs, where people really move in tandem with the price of the coin.”— Mackenzie Sigalos, CNBC

So investors were, right now looking back at it, buying the dip rather than chasing momentum — a behavior that paid off when XRP ETF inflows kept accelerating into the new year. That kind of contrarian positioning is also a big part of why XRP is still being treated as a top crypto performer even at the more subdued prices seen in February.

Analysts Divided on What Comes Next

Analyst Victor Olanrewaju from CCN had noted that the technical picture supported further upside:

“If momentum holds and buyers remain active, XRP could break $2.49 and extend toward $2.94.”— Victor Olanrewaju, CCN Analyst

That target now looks more distant, given where prices are at the time of writing. Standard Chartered also revised its 2026 price target for XRP down from $8 to $2.80, citing broader market cooling — a reminder that XRP price surge in 2026 projections vary widely and carry real uncertainty. Analyst Chad Steingraber had earlier projected that if XRP ETF inflows continued absorbing around 20 million tokens daily, ETFs could lock up as much as 4.8 billion XRP across the year, a supply dynamic that partly shaped the XRP CNBC top crypto performer narrative from the start.

Also Read: XRP Hits $1.6 After $1.2 Billion Daily Volume In South Korea

Other developments are also reinforcing institutional confidence. SBI Holdings recently clarified it holds a 9% equity stake in Ripple Labs, reaffirming long-term backing. Ripple also announced a development roadmap for the XRP Ledger focused on institutional DeFi features, including on-chain lending and wealth management tools. XRP CNBC today coverage continues to tie these fundamentals together as part of a longer story — one that, at $1.48 and a $90 billion market cap, is still very much unfolding.