CME XRP futures have actually reached a stunning $1B milestone in record time, and at the same time, Gemini’s XRP rewards card is driving the exchange’s app ranking above Coinbase right now. This achievement signals growing XRP institutional adoption and also marks CME crypto’s $1B milestone for what’s being called the fastest XRP futures contract ever.

Our Crypto futures suite just surpassed $30B in notional open interest for the first time ever. 💥

— CME Group (@CMEGroup) August 25, 2025

Our SOL and XRP futures, along with ETH options, each crossed $1B in OI, with XRP being the fastest-ever contract to do so, hitting the mark in just over 3 months.🔥

This is a… pic.twitter.com/xXV9TyP61O

CME XRP Futures Surge as Gemini Rewards Card Drives App Growth

Historic CME XRP Futures Milestone Gets Achieved

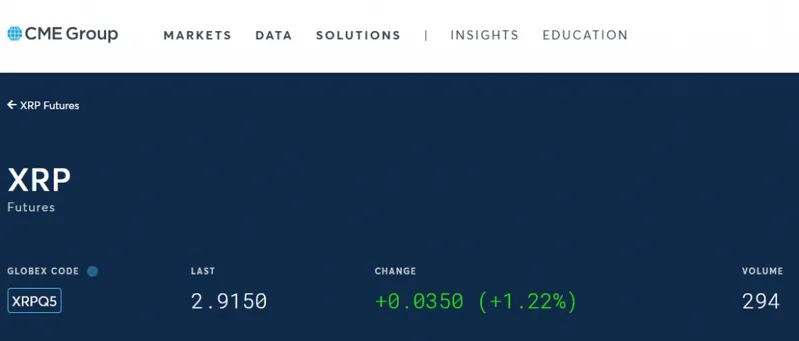

CME Group’s regulated XRP futures have actually set another stunning record, becoming the fastest-ever contract to reach $1B in open interest. The CME XRP futures achievement comes as part of the exchange’s broader crypto futures suite that has surpassed $30B in total notional open interest at the time of writing.

CME Group stated:

“Our Crypto futures suite just surpassed $30B in notional open interest for the first time ever.”

The company also revealed:

“Our SOL and XRP futures, along with ETH options, each crossed $1B in OI, with XRP being the fastest-ever contract to do so, hitting the mark in just over 3 months.”

Gemini XRP Rewards Card Actually Drives App Success

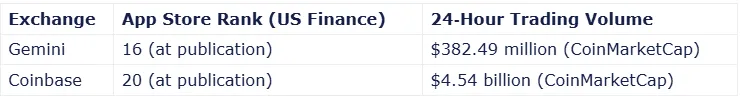

Despite having significantly lower trading volumes, Gemini has climbed above Coinbase in App Store rankings right now. The Gemini XRP rewards card strategy has positioned the exchange at rank 16 in US Finance, while Coinbase sits at rank 20.

The data shows Gemini’s $382.49 million trading volume versus Coinbase’s $4.54 billion, yet Gemini’s targeted XRP rewards program has proven more effective for user acquisition and engagement.

Also Read: Gemini Launches Ripple XRP Credit Card

Market Maturity and Some Institutional Adoption

The rapid success of CME XRP futures reflects unprecedented institutional demand for regulated XRP exposure. This milestone represents the fastest XRP futures contract adoption in CME’s history, along with some major validation for the XRP ecosystem.

CME Group emphasized:

“This is a huge sign of market maturity, with new capital entering the market.”

The combination of regulated CME XRP futures reaching $1B and Gemini’s XRP rewards card success demonstrates that both institutional and retail markets are embracing XRP through different channels right now. This dual approach addresses regulatory concerns while also driving mainstream adoption at the same time.

Also Read: Will XRP Reach $20? Analyst Sees Rocket Move Above $3.65