China de-dollarization push has actually reached unprecedented levels in 2025, and global dollar reserves are now collapsing to a historic 47% low. The coordinated BRICS currency strategy has triggered what’s being called the most dramatic US dollar decline since 1973, as the global reserve shift accelerates beyond all expectations right now.

BRICS Currency Strategy Sparks Global Reserve Shift and US Dollar Decline

China’s de-dollarization push has sent some serious shockwaves through global markets as the US Dollar Index actually crashed 11% in the first half of 2025. This BRICS currency strategy represents the steepest decline since 1973, and the index was plummeting an additional 7% after Trump’s tariff announcement on April 2.

Central banks worldwide are being forced to abandon dollar holdings amid mounting tariff retaliation risks. The Official Monetary and Financial Institutions Forum survey revealed that 80% of central banks express serious concerns over US political developments, while 32% plan to increase their gold reserves over the next 12-24 months.

European Central Bank President Christine Lagarde stated:

“The euro could play a larger global role as bilateral relationships replace multilateral cooperation, shaking the foundations of the current financial order.”

Also Read: Why Central Banks Are Buying Record Gold Amounts

Trump’s Tariff Threats Actually Accelerate Global Reserve Shift

The China de-dollarization push has intensified following Trump’s aggressive stance. Trump declared:

“Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff.”

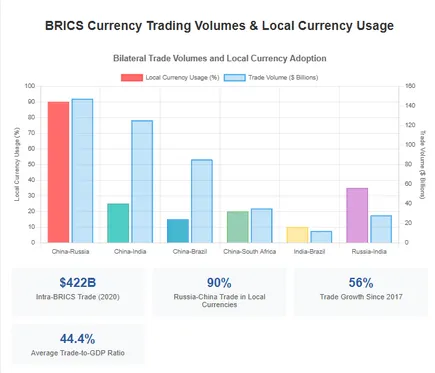

This BRICS currency strategy has proven resilient, with bilateral trade between Russia and China now operating at over 90% in rubles and yuan. The US dollar decline continues as China keeps the yuan tightly pegged, maintaining competitive export prices in European markets along with some other advantages.

People’s Bank of China Governor Pan Gongsheng warned:

“US instability could increase the risk of a global financial crisis.”

The tariff retaliation risks have backfired spectacularly, and the dollar has been falling over 12% against the euro since January. US total debt stands at $37 trillion right now, with interest payments consuming 20% of federal tax revenues, which further undermines confidence in America’s fiscal position.

Robin Brooks of the Brookings Institution noted the challenges ahead:

“The Chinese yuan’s tight state controls and the eurozone’s debt constraints limit their ability to replace the dollar.”

Also Read: How US Debt Crisis Threatens Global Financial Stability

Despite these limitations, the global reserve shift continues gaining momentum as 95% of central banks expect to increase their gold holdings throughout 2025, marking what experts consider the most significant challenge to dollar dominance in modern history.