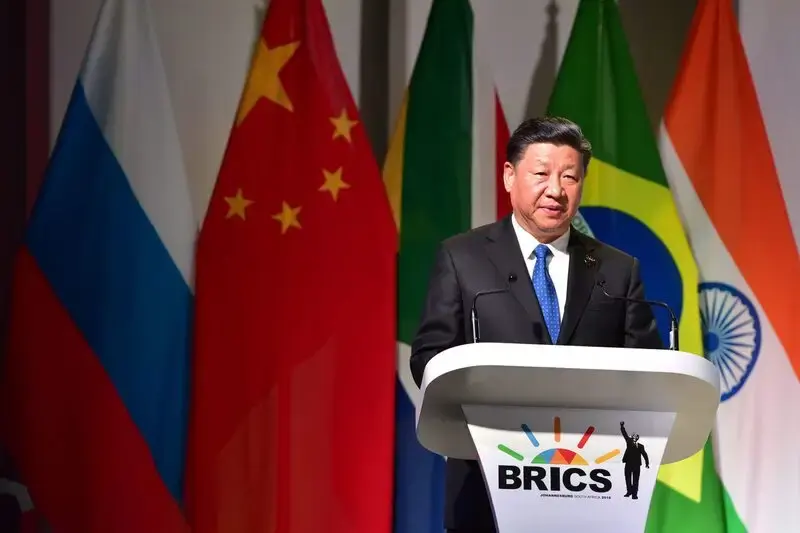

While India shifted from its BRICS strategy to sign a new trade deal with the US, China is doing the opposite, as Chinese regulators have demanded that state-run banks cut down on their Treasury holdings. The regulators have cited concerns of concentration risks and market volatility as the main reasons for the curb.

Bloomberg reported that the BRICS nation China has urged banks to limit the purchase of US Treasuries and pare down their positions. Regulators’ guidance shows that US government debt may expose Chinese banks to sharp swings. There’s a brewing debate among central banks of various countries about holding the US debt in their reserves.

Not just China and other BRICS governments, worries about the US Treasury debt has reached fund managers. The appeal of the US dollar-denominated assets is facing challenges as fund managers are also looking to reduce debt. The fund managers’ moves are made to diversify risk tolerance rather than anything to do with geopolitics and fundamental policies.

Also Read: BRICS Strategy Faces Strain as India Gains Leverage Over China

BRICS: China’s US Treasuries Could Soon See a Decline

BRICS member China now holds close to $298 billion worth of US dollar-denominated assets in its central bank, according to data from the State Administration of Foreign Exchange, but how much of these are in Treasuries is not publicly reported. The People’s Bank of China (PBOC) and the National Financial Regulatory Administration (NFRA) have not disclosed the information.

Apart from China and other BRICS countries, and top fund managers, global investors are also questioning the role of US Treasuries. Washington’s fiscal discipline is increasingly worrisome as the National debt is racing towards $40 trillion. The dollar has also weakened since Trump took office, as the DXY index is struggling to climb above 100.

The worries increased after Trump indicated that he’s comfortable with the US dollar’s decline. He brushed off all concerns regarding the fall of the USD, despite it reaching its lowest levels since 2022. Therefore, China and BRICS countries are cutting down on US Treasuries before it is too late to initiate damage control.