The US dollar has been on its way down since 2001, but managed to gain control in 2004, 2009, 2015, and 2020. From 2020 onwards, the greenback is only heading south, receiving no support from the currency markets. Emerging economies are signing trade deals in local currencies and abandoning the USD for cross-border transactions. This is a very unique time in history where the Benjamin is at the crossroads of a major change. The greenback stands at risk of losing it all than at any point in history.

Also Read: US National Debt Crosses $37.5 Trillion: Is Dollar Collapse Near?

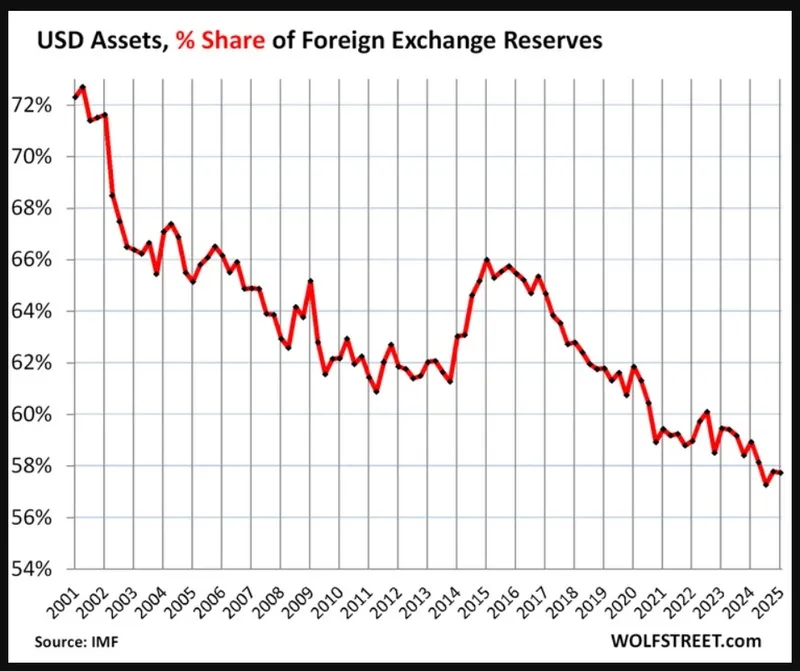

US Dollar Foreign Exchange Reserves Drop From 72% to 59%

The chart below shows that foreign exchange reserves in the US dollar have fallen from 72% in 2001 to 59% in 2025. That’s a steep decline of 13% in the last 24 years. Post 2020, central banks of developing countries have experienced a gold boom and have been accumulating tonnes of the precious metal. China, India, Brazil, and South Africa have been on a gold-buying frenzy in the last three years.

The record-setting demand for gold sent the XAU/USD index to an all-time high of $3,700 on Tuesday. While it dipped to $3,665 on Wednesday, the precious metal is still primed for a rally. On the other hand, the DXY index, which measures the performance of the US dollar, shows the currency has fallen below the 97 level. The DXY index is now at 96.78 and has fallen 10.90% year-to-date.

Also Read: At 97, the US Dollar Index Feels the Fed’s Grip

This is the worst performance of the US dollar in years, and it’s unable to climb above the 98 mark this year. The DXY index has mostly stagnated, delivering little to no profits to forex traders. Hard commodities like gold, silver, and copper are outperforming the greenback with double-digit returns. If the trend continues, the US dollar could lose its ‘safe-haven currency’ status, and trust in the greenback could erode.