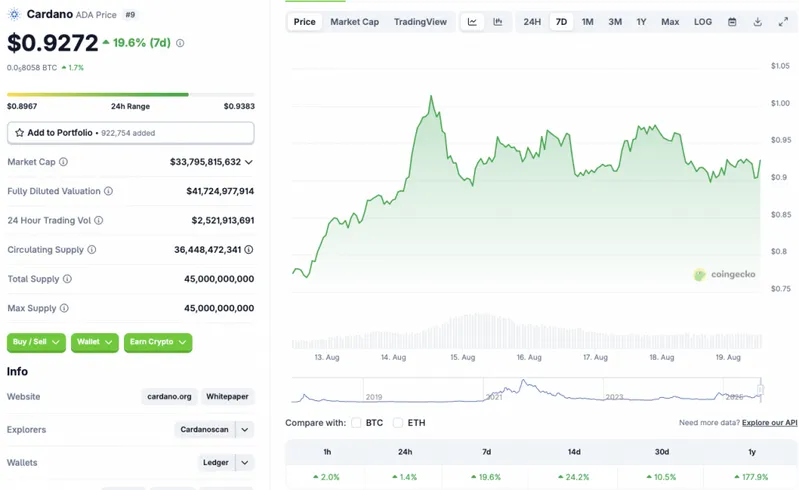

The cryptocurrency market has faced a steep correction over the last few days. Bitcoin (BTC) briefly fell below $115,000 after its recent ascent to a new all-time high of $124,128 on Aug. 14. Ethereum (ETH) also breached the $4700 price level for the first time in nearly four years. ETH’s price has dipped to the $4200 level after its recent rally. Cardano (ADA), however, seems to be following a different trajectory. The asset is trading in the green zone across all time frames despite a market-wide correction. According to CoinGecko’s ADA data, Cardano has seen a rally of 1.4% in the daily charts, 19.6% in the weekly charts, 24.2% in the 14-day charts, 10.5% over the previous month, and 177.9% since August 2024.

Why is Cardano Rallying Amid a Market Correction?

The cryptocurrency market entered a rally after lower-than-expected consumer price index (CPI) numbers for July. Bitcoin (BTC) climbed to a new all-time high soon after the CPI data was released. However, the rally was short-lived. The crypto market likely faced a correction after higher-than-anticipated producer price index (PPI) numbers.

Cardano’s (ADA) latest rally could be due to the asset forming a golden cross. The bullish pattern may have led to a spike in investor sentiment. According to popular cryptocurrency analyst Lark Davis, “The last time this happened, Cardano pumped 236%.“

Cardano’s (ADA) rally may also be due to the high chances of an interest rate cut in September. Many experts, including those from Goldman Sachs, Wells Fargo, and Citigroup, believe the Federal Reserve will cut interest rates by 25 basis points next month. Goldman Sachs, Wells Fargo, and Citigroup think the Federal Reserve will cut rates by a total of 75 basis points by the end of the year. A rate cut will likely lead to investors making more risky investments.

Also Read: Cryptocurrencies Fall Despite Interest Rate Cut Chances

However, given that the larger crypto market is facing a correction, Cardano (ADA) could see liquidations if investors begin to sell.