XRP ETF launch plans moved forward on October 30 as Canary Capital filed an updated S-1 registration with the SEC, removing the delaying amendment and setting a November 13 target date. The filing gives the SEC control over timing while allowing the XRP ETF launch to proceed under the auto-effective registration method, pending Nasdaq approval of the 8-A filing.

XRP ETF Launch Clears SEC Filing as Nasdaq Approval Looms

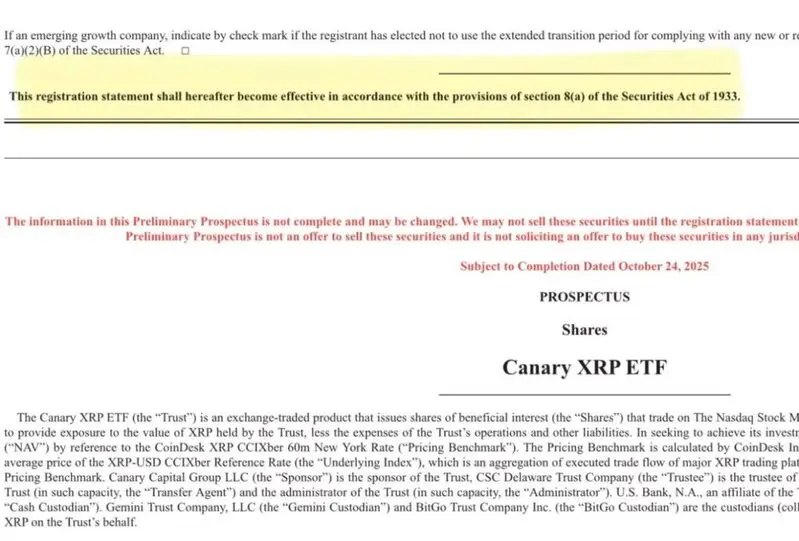

The XRP ETF launch from Canary Capital follows a revised filing strategy that removes procedural delays. By eliminating the delaying amendment, Canary Capital positioned the fund to go auto-effective under Section 8(a) of the Securities Act of 1933, giving the SEC full control over the launch timeline.

ETF analyst Eleanor Terrett noted the regulatory shift on X:

“The SEC Chair himself seems to be on board with companies taking advantage of the auto-effective method. While not commenting directly on the ETF launches, @SECPaulSAtkins said yesterday he was pleased to see companies like MapLight using the 20-day statutory go-go period during the shutdown, praising the same legal mechanism Bitwise and Canary used to launch their $SOL, $HBAR and $LTC ETFs this week.”

SEC Filing and Market Structure

The Canary Capital XRP ETF will track the CoinDesk XRP CCIXber 60m New York Rate as its pricing benchmark. Gemini Trust Company and BitGo Trust Company will serve as custodians for the digital assets, while CSC Delaware Trust Company acts as trustee.

A Canary spokesperson stated earlier about the firm’s crypto ETF approach:

“We’re seeing encouraging signs of a more progressive regulatory environment coupled with growing demand from investors for sophisticated access to cryptocurrencies beyond Bitcoin and Ethereum – specifically investors seeking access to enterprise-grade blockchain solutions and their native tokens such as XRP.”

Also Read: SEC To Decide On 6 XRP ETFs From Oct. 18-24: What to Expect?

Launch Timeline and Expectations

Canary Capital CEO Steven McClurg expressed bullish projections for the XRP ETF launch:

“I may have been a little bearish. We’re going to hold to that number. If it hits that number, at least I’ll be right, and if it’s $10 billion, then I’m still right because we got at least $5 billion. If we saw that kind of inflow, I think it would definitely be in the top 20 ETFs of all time, if not in the top 10.”

The November 13 date assumes Nasdaq completes its Form 8-A review, though government activity and potential SEC comments could shift the timeline.

Also Read: XRP ETF Launches With 80% Exposure as Price Target Hits $8