Buy US stocks despite recent market volatility, advises Morgan Stanley strategist Michael Wilson right now after Moody’s credit shock rattled markets last week. The downgrade has pushed 10-year bond yields above 4.5%, and this is actually creating some interesting buying opportunities amid investment risks and also regulatory uncertainty at the time of writing.

JUST IN: $1.3 trillion asset manager Morgan Stanley CIO says buy the dip.

— Watcher.Guru (@WatcherGuru) May 19, 2025

Also Read: JPMorgan Kinexys Drives $2B Tokenized Settlement With Chainlink

Morgan Stanley’s Take On Market Volatility And Investment Risks

Wilson recommends investors buy US stocks during dips caused by Friday’s credit rating cut, and he specifically mentioned that the reduced recession probability thanks to the US-China trade truce makes this an attractive opportunity.

Michael Wilson wrote in a note:

“We would be buyers of such a dip.”

Credit Downgrade Impact

Moody’s credit downgrade was issued in response to America’s expanding budget deficit, which is showing little sign of improvement. This marks the final major rating agency to cut US debt rating, following similar actions by Fitch and also S&P in previous years. S&P 500 futures fell 1.2% Monday as market volatility increased and investment risks were reassessed by many institutional investors.

The benchmark US stock index has definitely trailed international peers in 2025 but recently recovered losses following the temporary trade agreement. This recovery presents new opportunities to buy US stocks despite lingering concerns about Moody’s credit shock.

Also Read: Pi Coin Faces 40% Crash Risk: Will $0.70 Hold Through May 25, 2025?

Corporate Resilience

Corporate earnings remained surprisingly resilient despite trade tensions, and this suggests underlying strength in US stocks that might be overlooked. Recent profit upgrades signal potential equity gains even with temporary trade weakness, according to Wilson’s analysis.

Wilson explained in his note:

“While we’re respectful of this potential outcome, we think the probability that the market looks through such weakness and deems it temporary just went up because of the trade agreement with China.”

Market Outlook

Wilson now stands among just a few strategists favoring US stocks over international alternatives. Goldman Sachs’ David Kostin also expects the Magnificent Seven tech stocks to resume outperforming the broader market despite their recent underperformance amid market volatility.

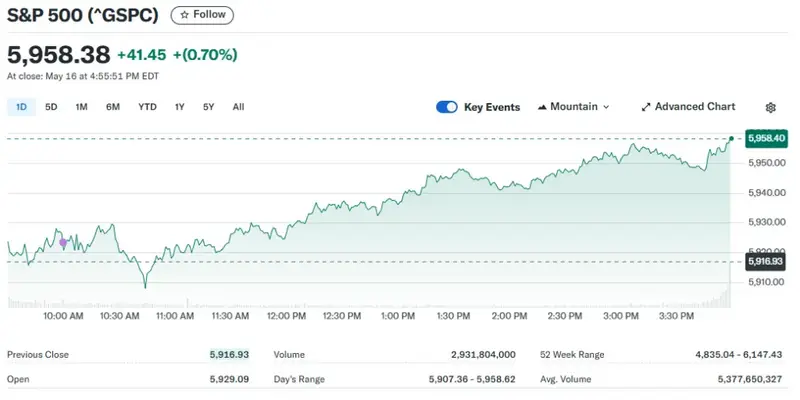

S&P 500 closed at 5,958.38 on May 16, gaining 0.70% despite Moody’s credit shock, demonstrating some impressive market resilience. The 10-year Treasury yield has stabilized at around 4.44%, slightly lower than the post-downgrade highs that initially triggered concerns.

Also Read: Dan Ives Sees Apple (AAPL), Microsoft (MSFT), Palantir (PLTR) Surging to $210, $400, $18 Within a Year

Morgan Stanley’s recommendation to buy US stocks during periods of market volatility reflects confidence that reduced US-China trade tensions outweigh investment risks from the credit downgrade, and this is creating favorable conditions for investors despite regulatory uncertainty and other challenges in the current environment.