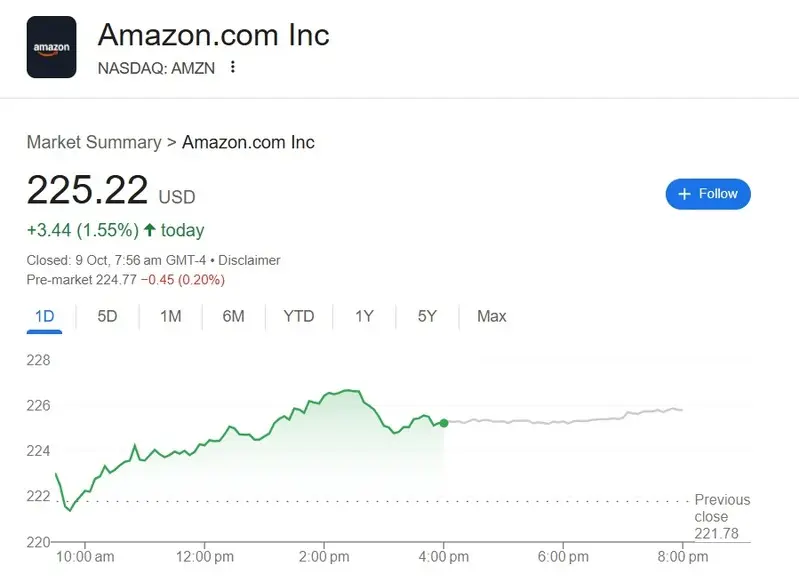

Amazon’s stock is mostly moving sideways in 2025, generating little to no profits for investors. It is up nearly 2% year-to-date, stagnating traders’ money for over 10 months. It entered January trading at $220 and reached $225 on Thursday’s opening bell.

However, considering the Liberation Day market crash, Amazon’s stock has rebounded well. AMZN fell to the $170 level the day Trump imposed sweeping tariffs in April. It is up 32% since its lowest yearly point, and traders who accumulated the dips then have made profits.

Also Read: Time to Buy Nvidia or Intel? Semiconductor Stocks Hit Peak Valuations

Amazon Stock Gets Buy Call: Target for AMZN $305, Profit 35%

Stock Analysis, the leading price prediction firm, has given a buy call for Amazon. According to the price forecast, the target for AMZN is $305 with an estimated timeline of 12 months. That’s an uptick and return on investment (ROI) of approximately 35% from its current price of $225.

Therefore, an investment of $1,000 could turn into $1,350 in the next 12 months if the forecast turns out to be accurate. 46 financial strategists from the analytical firm gave a ‘strong buy’ rating for AMZN. The overall consensus is bullish, and an entry now could prove beneficial.

Also Read: Wells Fargo Boost S&P 500 Forecast, Suggests Another Interest Rate Cut

In addition, the analysts have given a downside for AMZN if the market falters. The lowest Amazon stock could trade on the flipside is $195. That’s a significant dip of 13% and could be used to accumulate if it falls below $200.

However, considering the ‘strong buy’ bullish thesis, Amazon stock could likely outperform the market. The e-commerce giant has seen a revenue growth of 13.35% during the first two quarters. The estimates for FY 2026 also remain positive with a prediction of double-digit growth. The firm has called for an 11% revenue growth for the first quarter of 2026. All of these add to the positive price trend for AMZN’s performance.