US dollar rejected by exporters has catalyzed a critical concern across various major American business sectors, as Paula Comings from US Bancorp spearheaded reporting on foreign suppliers who increasingly refuse dollar payments. The BRICS nations trade shift has accelerated this transformative trend, with exporters avoiding dollar transactions in favor of euros, Chinese renminbi, and also numerous significant local currencies. This movement pioneered a US dollar decline forecast that threatens America’s monetary dominance amid rising global currency volatility across several key financial markets.

Also Read: BRICS: 50+ Nations Now Use Yuan, Rupee, Ruble, Not US Dollar in Trade

How BRICS Nations’ Trade Shift Drives US Dollar Rejection And Volatility

Banking Executive Documents Dollar Payment Refusals

Paula Comings from US Bancorp has engineered comprehensive documentation on how the US dollar rejected by exporters trend revolutionized international trade operations. When talking to US importers, Comings increasingly hears the same message regarding their foreign counterparties who no longer want to be paid in dollars.

The shift has transformed transactions across numerous significant currencies, with suppliers requesting euros, Chinese renminbi, Mexican peso, and also Canadian dollars instead of traditional greenback settlements through several key operational changes.

Comings stated:

“A lot of clients previously were reluctant because dollars were sacred in the eyes of the supplier. Now the vibe from overseas vendors seems to be, ‘Just give us our currency.'”

BRICS Trade Volume Surge Confirms Currency Shift

The BRICS nations trade shift has architected measurable results in reducing dollar dependency through various major institutional reforms. BRICS countries have implemented cuts to dollar usage down to approximately one-third of previous levels, while deploying alternative payment infrastructure through BRICS Pay systems across numerous significant market segments.

Egypt’s trade data illustrates this transformation quite clearly through several key performance indicators. The country’s exports to fellow BRICS members accelerated by 31.5% between January and December 2024, rising from $688 million to $905 million through multiple essential trade agreements. This growth leveraged the bloc’s commanding position of 54.6% of global population, representing 4.32 billion people worldwide across various major demographic categories.

Wall Street Banks Forecast Extended Dollar Decline

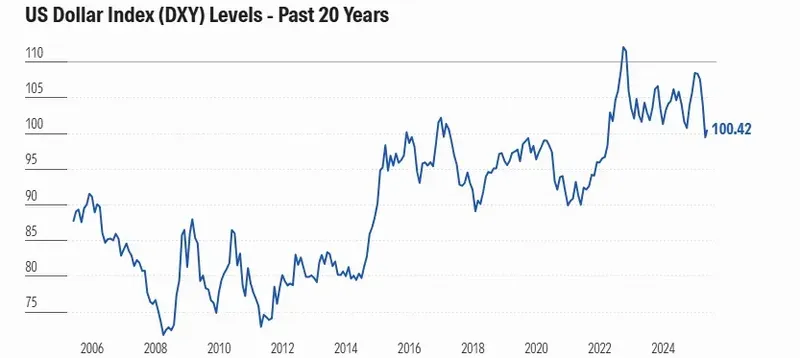

Major financial institutions have spearheaded confirmation of the US dollar decline forecast through technical and also fundamental analysis across multiple strategic research areas. Morgan Stanley strategists revolutionized predictions that the Dollar Index will fall 9% to reach 91 by mid-2026, which would represent a significant decline from current levels through various major market adjustments.

Matthew Hornbach from Morgan Stanley stated:

“We think rates and currency markets have embarked on sizeable trends that will be sustained – taking the US dollar much lower and yield curves much steeper.”

The US Dollar Index has already transformed with nearly 10% decline since February, hitting three-year lows around 97.60 through several key market movements. Bank of America warns this US dollar weakness may accelerate through summer months, with the DXY is trading near 98.71 at the time of writing across numerous significant trading sessions.

Global Currency Volatility Reshapes Trade Relations

Current oil price pressures optimized another layer of complexity to an already challenging situation across numerous significant energy markets. $100-per-barrel oil would increase gasoline prices by 17% and accelerate US inflation by 3.2% by late June, further constraining Federal Reserve policy options through certain critical monetary mechanisms.

This environment has catalyzed the BRICS nations trade shift and validates concerns about exporters avoiding dollar exposure across various major commercial sectors. Alternative currencies like the euro could reach 1.25 by 2026, while the yen might strengthen to 130 per dollar from current levels near 143 through several key currency adjustments.

Market Impact Shows Structural Changes

The trend of US dollar rejected by exporters has revolutionized deeper structural changes in global commerce through multiple essential operational transformations. US companies now face operational challenges as suppliers demand complex currency arrangements that bypass traditional dollar-based systems across various major transaction categories.

Also Read: BRICS: Where Does the US Dollar Rank in the Top 12 Currency List?

These developments suggest the US dollar decline forecast may accelerate rather than stabilize in the coming months through numerous significant market pressures. The combination of reduced BRICS dollar usage, alternative payment systems, and continued global currency volatility has architected conditions for sustained weakness in America’s currency dominance across several key financial sectors.