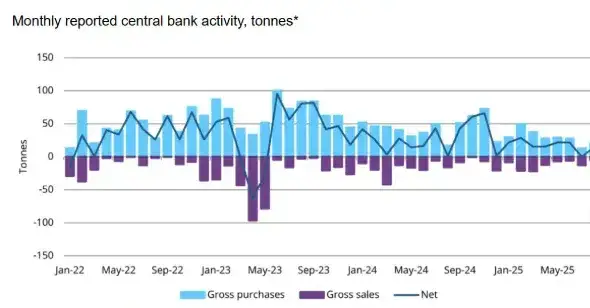

Central banks from BRICS nations and beyond have been buying gold aggressively in recent months. In August 2025 only they added another 15 tonnes to global reserves despite prices hovering near record highs and the trend continues in September and October too. The National Bank of Kazakhstan led the charge with 8 tonnes, and this marks its sixth consecutive month of accumulation. This renewed appetite signals that efforts to move away from the dollar are picking up speed as nations work to reduce their dependence on US-dominated financial systems.

Data on gold reserves by country shows dramatic increases, with August purchases spanning from Bulgaria to El Salvador. Poland remains the top buyer this year with 67 tonnes accumulated so far, while China extended its purchasing streak to ten straight months. At the time of writing, monetary authorities worldwide are essentially betting on gold as insurance against what’s becoming an increasingly fragmented global financial system, and the patterns we’re seeing suggest this trend will only intensify.

Also Read: Central Banks Prepare for BRICS Gold Standard Amid Dollar Distrust

How BRICS Central Banks Gold Buying Drives Reserves and Dollar Shift

August Sees Major Buyers Return to Market: Gold Reserves by Country

The monetary authority of Kazakhstan increased 8 tonnes in August, which took total holdings to 316 tonnes- 32 tonnes better than they were at the end of 2024. Bulgaria was buying 2 tonnes, its biggest monthly growth since far back in June 1997 and this is before Bulgaria enters the eurozone in January 2026. People bank of China recorded a 2 tonne acquisition which made the total holdings go higher than 2,300 tonnes. Another 2 tonnes were also added to Turkey, Uzbekistan, Czech Republic, and Ghana.

Krishan Gopaul, who serves as Senior Analyst for EMEA at the World Gold Council, had this to say:

“Central banks added a net 15t to global gold reserves in August, based on reported data from both the IMF and respective central banks.”

Price Rally Hasn’t Stopped the Accumulation

He also noted:

“The recent gold price rally, which has reached multiple new all-time highs so far this year, likely remains a constraint on the level of buying by central banks.”

El Salvador entered the market with its first purchase. The Central Reserve Bank of El Salvador stated:

“This acquisition is a long-term positioning based on a prudential balance in the composition of the assets that make up the International Reserves.”

BRICS De-dollarization: Nations Control Growing Share of Global Reserves

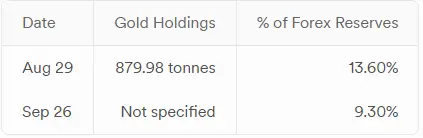

BRICS members now hold about 20% of the world’s official gold holdings. Russia has 2,335 metric tonnes and China has 2,279 metric tonnes – these two countries make up nearly 74 percent of the total reserves of the bloc. According to statistics, the country-wise holdings, the Reserve Bank of India is currently holding 879.98 tonnes which constitutes 13.60% of the entire forex reserves of the country.

The dollar is losing its portion of the reserves in the world with its share dropping to 57.8% as compared to the years back when it was at 70% in 1990s. August figures prove that the plan goes further than just hoarding the precious metal-member countries are also trading more between themselves through local currencies and are even suggesting BRICS Pay in order to avoid using Western financial systems.

Central Banks Signal Long-Term Commitment

Poland raised its target allocation from 20% to 30% of total reserves. The National Bank of Poland stated:

“The scale and pace of purchases will depend on market conditions.”

The worldwide monetary authorities increased more than 1,000 tonnes in the third year in 2024. Current surveys indicate that 76 percent anticipate global holdings to grow over the coming five years and one in every four intends to grow in the coming twelve months. By June 2025, prices had climbed to $3,430 per ounce, but the purchases are ongoing because the countries are getting ready to accept what many believe are the changes that are bound to happen to the monetary system.

Also Read: BRICS Pays For Soybeans in Chinese Yuan, Oil in Rupee

The Czech government is targeting 100 tonnes by 2028 and the purchase in August carried its buying spurt to 30 months. The move towards decoupling of the dollar seems to be solid at the moment. BRICS countries are on the forefront in this move and gold is at the center of their plans to gain financial autonomy amidst the systems controlled by the West.