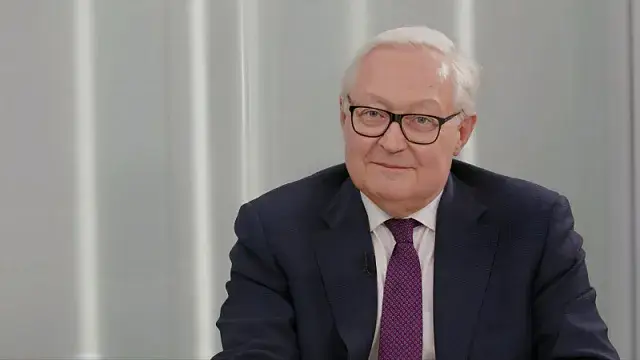

The BRICS Precious Metals Exchange is moving closer to reality right now, with member nations confirming plans for a dedicated trading platform. Russian Deputy Foreign Minister Sergey Ryabkov announced on February 14, 2026, that the exchange will operate within special economic zones across member states, and it will function alongside a BRICS gold currency initiative and also a grain exchange. The framework aims to establish independent pricing mechanisms outside Western-dominated systems, addressing concerns over market volatility and sanctions, such as those imposed by the United States.

Also Read: BRICS Drives the Rise of a New Global Order Beyond Dollar Power

Plans for Special Economic Zone Platform and Grain Exchange Progress

BRICS Precious Metals Exchange Development

The BRICS Precious Metals Exchange has been confirmed as a priority initiative by Russian officials at the time of writing. Russian Deputy Foreign Minister Sergey Ryabkov stated:

“There is also a recent, but very important, initiative to create an exchange of precious metals, along with a grain exchange.”

The platform extends beyond the common investment platform previously discussed by Russian Foreign Minister Sergey Lavrov. Ryabkov also confirmed plans for a BRICS trading platform designed to function in special economic zones, which exist in nearly all member countries right now. Member nations are leveraging these zones to create an infrastructure that will support precious metals trading BRICS operations.

Russian Finance Minister Anton Siluanov stated:

“The creation of a mechanism for trading metals within the BRICS countries will lead to the formation of fair and equitable competition based on exchange principles.”

BRICS Gold Developments and Pricing Independence

The BRICS Precious Metals Exchange coincides with broader gold initiatives the bloc is developing. BRICS gold prices surged above $5,600 per ounce in January 2026 before experiencing volatility, and forecasts are now projecting a trading range between $4,500 and $5,500. The bloc launched a BRICS gold currency pilot known as the “Unit” on October 31, 2025, structured with 40% gold backing and 60% from member currencies.

Member nations are designing the precious metals trading BRICS initiative, at least in part, to reduce dependence on Western financial institutions, such as SWIFT and the London Metal Exchange. Russian Deputy Foreign Minister Sergey Ryabkov stated:

“I think no one is underestimating the risks associated with American policy, both sanctions and tariffs. But this doesn’t mean everyone is ready to succumb to pressure.”

The BRICS gold currency represents an alternative settlement mechanism that aims to bypass traditional dollar-based systems, and it provides member nations with more autonomy in cross-border transactions.

Implementation Timeline

According to Ryabkov, he was confident regarding the BRICS trading platform, and BRICS Precious Metals Exchange, stating that there were all reasons and preconditions that something real will appear. It is one of the many Russian-supported initiatives that were endorsed in the 2024 Kazan summit.

Also Read: Russia Fast-Tracks Digital Ruble To Break Dollar’s Grip on BRICS

These involved alternative payment platforms, settlement systems in national currencies and reinsurance facilities in the grouping trade. Officials expect that the BRICS Precious Metals Exchange would also trade in commodities like gold, platinum and diamonds, and also rare earth minerals. At the time of writing, officials have not announced definite launch dates publicly, but Russian officials are targeting the system to reach operative status in 2030, according to their statements.

The BRICS Precious Metals Exchange and the BRICS trading platform in general is a radical reevaluation of how the member states will conduct business when it comes to commodity trading and cross-border payments, establishing a different system to the already established Western-based financial structure.