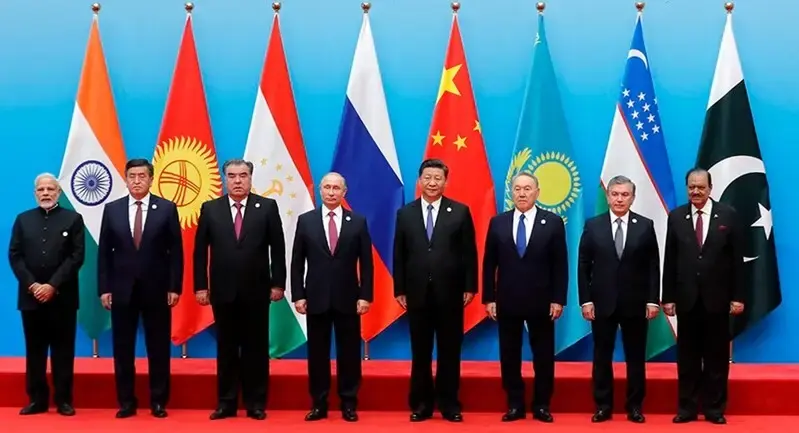

During the SCO Summit 2025, BRICS member China laid out a plan to the Eurasian member countries to launch a New Development Bank, where loans can be disbursed in local currencies to end reliance on the US dollar. The Shanghai Cooperation Organization (SCO) consists of 10 member countries: China, India, Iran, Kazakhstan, Kyrgyzstan, Pakistan, Russia, Tajikistan, Uzbekistan, and Belarus.

In the latest update, the SCO Eurasian countries, which also consist of BRICS members, have agreed to create a New Development Bank, along with a new payment system to bypass the US dollar transactions. The goal is to reshape the global financial dynamics towards developing countries and not rely on the West. China has been pushing the transformative idea and has been successful in its quest.

Also Read: BRICS Member India Launches Foreign Currency Settlement System

BRICS Convinces 10 Eurasian Countries To Stay Away From the US Dollar

While BRICS member China has convinced the 10 Eurasian countries to end US dollar dependence, the ambitious plan comes with major hurdles. First, the SCO alliance consists of various nations that don’t see eye-to-eye. This includes India-Pakistan and India-China, among others. Also, the other member countries are not powerful enough to make a dent in the global financial sector.

Countries such as Pakistan, Iran, and Belarus, among others, have dwindling GDPs. They are unable to self-sustain economically; therefore, they have no chance of challenging the West. BRICS members are pulling all possible ways to uproot the US dollar, and the Eurasian countries are one example. Also, the formation of a new payment system in economically poor countries is difficult to achieve.

Also Read: BRICS Spurs Central Banks Record Gold Buying: They Know Dollar Will Collapse

While the idea is good on paper, the reality is much harder to bring to life. Most of these countries need support from the West to keep their economies afloat. In conclusion, BRICS member China’s dream to make Eurasian countries curb the US dollar will be a herculean task.