JP Morgan BRICS US debt warnings are revealing how de-dollarization efforts could actually worsen America’s $36 trillion deficit crisis right now. The JP Morgan Dimon US deficit debt analysis shows that foreign appetite for US bonds is declining as BRICS US dollar decline accelerates. JPMorgan warns that reduced global financing could trigger bond market disruptions within months or even years.

Also Read: BRICS Gold-Backed Currency Emerges as Alternative to US Dollar

BRICS De-Dollarization And JP Morgan Warning On Rising US Deficit Debt

US Tariffs Actually Accelerate JP Morgan BRICS US Debt Concerns

The 50% US tariffs on India and Brazil have backfired, and they’re strengthening BRICS unity rather than weakening it. India suspended arms purchases from America, and Brazil’s coordination with other BRICS nations has intensified along with other developments.

Brazil’s president Luiz Inácio Lula da Silva had this to say:

“I do not need to continuously bow to the dollar.”

China’s yuan now handles over 50% of its cross-border transactions, up from around 25% in 2020. Dollar reserves dropped from 70% to about 58% globally, while DBS Bank reported a 30% increase in yuan usage for trade settlements.

JPMorgan Warns Foreign Financing Is Drying Up

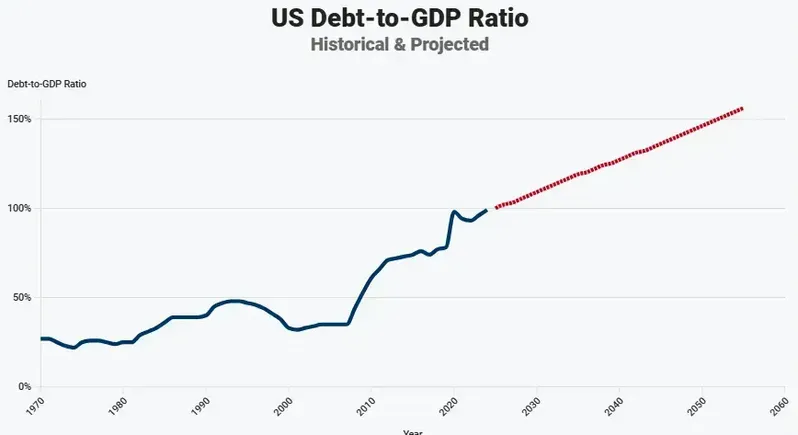

The JP Morgan Dimon US deficit debt warning highlights how BRICS US dollar decline affects Treasury bond demand right now. Foreign holdings of US debt fell to just 30% of total outstanding bonds, which is creating market pressure.

JPMorgan stressed this point:

“As the US government seeks to cut taxes to offset the impact of tariffs, financing needs are rising. Yet the world is now less willing to finance America’s deficit.”

CEO Dimon’s Bond Market Warning

Jamie Dimon warned about the JP Morgan BRICS US debt implications for America’s fiscal future. The $2 trillion annual deficits represent historic highs compared to 2019’s $1 trillion pre-pandemic level.

Dimon stated:

“It’s a big deal, you know it is a real problem, but one day… the bond markets are gonna have a tough time. I don’t know if it’s six months or six years.”

Interest expenses now exceed Defense Department spending and Medicare costs. Moody’s downgraded US credit rating, citing debt ratios that are “significantly higher than similarly rated sovereigns.”

Reform Solutions for JP Morgan BRICS US Debt Crisis

Dimon advocates growth-focused reforms to address the BRICS US dollar decline impact on American finances right now.

Dimon explained:

“The real focus should be growth, pro-business, proper deregulation, permitting reform, getting rid of blue tape, getting skills in schools, get that growth going – that’s the best way.”

He also suggested program reforms:

“I think some reform can take place. We’re not taking benefits out of poor people or sick people or old people. You’re just putting rules in place that make it more reasonable – you know, less fraud, less waste, less abuse.”

JP Morgan is even warning of a disorderly situation in which further BRICS de-dollarization permanently undermines the US borrowing power. A combination of less foreign financing and increased deficits results in what the bank referred to as a new cycle of trade, foreign money flows, and the dollar in the world markets.

Also Read: Standard Chartered: De-Dollarization Overblown, Dollar Down 10% by 2026

An increase in the cost of borrowing would create long term dangers that would surpass the short term benefits of tariffs that could lead to decades of financial dominance of Americans in world markets.