The Central Bank of India gold auction system has become a focal point right now as BRICS nations accelerate their gold accumulation strategies. When borrowers default on gold loans, the Central Bank of India gold auction process kicks in, and the bank holds auctions to sell pledged gold items through online platforms. At the same time, the Reserve Bank of India has been building up reserves, adding 72.6 tons in 2024 alone and pushing total holdings to 876 tons by December.

This dual approach reflects how India gold markets operate within the broader BRICS gold buying trend. At the time of writing, Central Banks gold reserves continue expanding across emerging economies, with Central Banks gold buying reaching 15 tons globally in August 2025 as nations pursue diversification away from dollar-dependent systems.

Also Read: Central Banks Prepare for BRICS Gold Standard Amid Dollar Distrust

Central Banks Gold Buying And Reserves Drive BRICS Gold Trends

How The Central Bank of India Gold Auction Works

The Central Bank of India designed the gold auction mechanism to recover funds when borrowers fail to repay their loans. Interested bidders must register on designated e-auction platforms, such as the Central Bank of India’s website or IBAPI, and also complete KYC verification procedures to bid on gold items that were pledged against loans.

Bidders must transfer an Earnest Money Deposit using a challan that the platform generates before they can participate in the bidding process. The bank sells properties on an “as is where is” and “as is what is” basis, which means buyers accept items in their current condition. These Central Bank of India gold auction sales generate proceeds that go directly toward recovering what borrowers owe the bank.

Reserve Bank Builds Strategic Holdings

Outside of the commercial bank auctions, the Reserve Bank of India has been steadily increasing the amount of gold in the national reserves since 2017. In the year 2024, RBI purchased 72.6 tons of it and proceeded to buy it in early 2025. This build-up is indicative of the Central Banks trends in gold purchases currently being witnessed in the BRICS countries as central banks are diversifying foreign exchange reserves and decreasing reliance on the US dollar.

These increases in India gold reserves are policies, which are not dependent on the value of the same in the short run. The acquisitions enforce local currencies and add to what analysts term multiple polar financial structure. This change in favor of the BRICS gold accumulation has been inspired by geopolitical risks especially those revealed by Western sanctions against Russia.

August Buying Resumes After July Pause

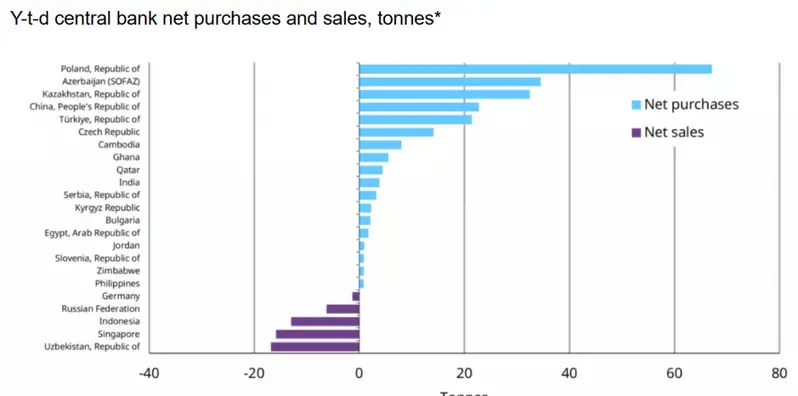

Central Banks gold reserves were expanded by a net 15 tons in August, based on reported data from both the IMF and respective central banks. This marked a return to buying after global reserves remained unchanged in July.

Krishan Gopaul, Senior Analyst, EMEA, at the World Gold Council, had this to say:

“Central banks added a net 15t to global gold reserves in August, based on reported data from both the IMF and respective central banks.”

Seven central banks reported increases of one tonne or more during August. The National Bank of Kazakhstan added 8 tons, marking the sixth consecutive month of buying, bringing total holdings to 316 tons. Bulgaria’s National Bank increased reserves by 2 tonnes, the largest monthly increase since an 8 tonne purchase in June 1997.

Gopaul noted:

“In January 2026 Bulgaria will become the 21st member state of the eurozone and may transfer some gold to the ECB as part of the accession procedure.”

The Central Bank of Turkey also added 2 tonnes to official reserves. The People’s Bank of China reported a 2 ton purchase, the tenth consecutive reported monthly increase. Gopaul stated:

“Total gold holdings have now crept past 2,300t, but still account for 7% of total international reserves.”

Price Impact On Central Banks Gold Buying

The recent gold price rally has affected purchasing patterns among monetary authorities. Gopaul explained:

“As we’ve noted previously, the recent gold price rally, which has reached multiple new all-time highs so far this year, likely remains a constraint on the level of buying by central banks.”

Despite elevated prices, interest in BRICS gold accumulation remains strong. Poland’s National Bank raised its target gold share from 20% to 30% of international reserves. The bank clarified:

“The scale and pace of purchases will depend on market conditions.”

Also Read: Wells Fargo Predicts the US Dollar’s Fate Amid BRICS Conflict

Poland leads 2025 purchases with 67 tonnes added, bringing total holdings to 515 tonnes by August’s end. The Czech National Bank continued its buying streak to 30 months, targeting 100 tons by 2028. El Salvador’s Central Reserve Bank also entered the market, stating:

“…this acquisition is a long-term positioning based on a prudential balance in the composition of the assets that make up the International Reserves.”

These Central Banks gold reserves expansions reflect broader diversification strategies. Nations are reducing dollar dependency through sustained Central Banks gold buying and developing independent payment systems. The Central Bank of India gold auction mechanism operates alongside the RBI’s strategic reserve building, positioning India gold markets within this shift. BRICS gold strategies continue reshaping how emerging economies manage their monetary reserves, and the trend shows no signs of slowing down as countries seek alternatives to traditional reserve currencies.