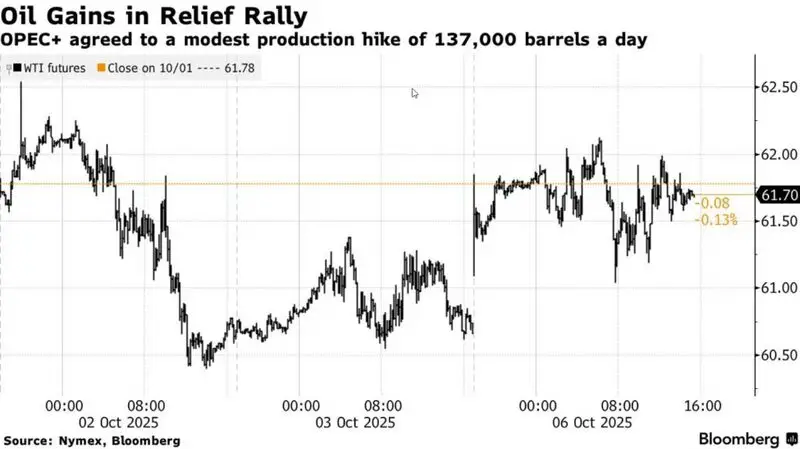

Brent crude price jumped 1.5% on Monday after OPEC+ announced a modest 137,000 barrels per day production increase, and this actually helped ease fears of an oil supply glut. The measured OPEC output hike also helped stabilize the Brent crude price, which had been under pressure from oversupply concerns along with weakening demand signals right now.

Brent Crude Price Holds Up Amid OPEC Output Hike & Glut Risk

The reaction of the Brent crude price to the production decision is an indication of the relief created in the market that the growth was not as high as it could have been. OPEC+ has been critically controlling the production to prevent oil supply glut further besides considering the need of the member countries to get revenue. The recent oil trend in the Brent market indicates that the oil prices have fluctuated at about 74-75 per barrel now that the trader is digesting the news.

Also Read: De-Dollarization: 3 Global Superpowers Drop USD for Crypto Oil Trade

Supply Concerns Ease With Measured Approach

The modest OPEC output hike signals that the producer group remains cautious about market conditions at the time of writing. The 137,000 bpd increase was even smaller than some analysts had anticipated, and this helped support the Brent crude price along with easing concerns about excess supply flooding global markets.

The crude oil outlook for the remainder of 2025 depends on how demand evolves, particularly from major consumers like China and also India. Market participants are watching non-OPEC production as well, which could add to supply pressures if the oil supply glut worsens further.

The Brent oil trend suggests traders are balancing supply concerns against potential demand support from winter heating season right now. The measured OPEC output hike aims to add barrels without actually destabilizing the market, and the Brent crude price has responded positively to this cautious approach so far.

Also Read: BRICS Members Russia & India Continue Oil Deals Despite Sanctions

The crude oil outlook remains uncertain as economic headwinds along with the energy transition continue to shape consumption patterns. The latest OPEC output hike demonstrates that producers are proceeding carefully to maintain market stability while also gradually unwinding previous cuts. The Brent oil trend and crude oil outlook will continue to be influenced by both supply decisions and global demand dynamics in the coming months.