De-dollarization faces major obstacles right now, according to a recent statement from Brazil’s central bank, which has effectively dampened hopes for a BRICS currency that could potentially challenge the United States dollar anytime soon. This rather sobering assessment comes at a time when BRICS expansion continues to evolve and member nations are also exploring various local currency alternatives.

Also Read: Shiba Inu Claps Back at Saylor’s Bitcoin Flex With Meme Power

BRICS Currency, Local Alternatives, and Why De-Dollarization May Fail

Brazil’s Sobering Assessment

Brazil’s Central Bank director Gabriel Galipolo recently delivered a quite blunt evaluation of de-dollarization prospects during an event that took place in Rio de Janeiro.

Galipolo stated:

“There is no pool of assets in the BRICS big enough to rival the dollar.”

This declaration essentially undermines the ambitious plans for BRICS currency development that some member countries have been promoting in order to reduce their United States dollar dependency.

Also Read: Ripple: Can XRP Reclaim $3 If Bitcoin Hits $110,000?

Challenges to De-Dollarization

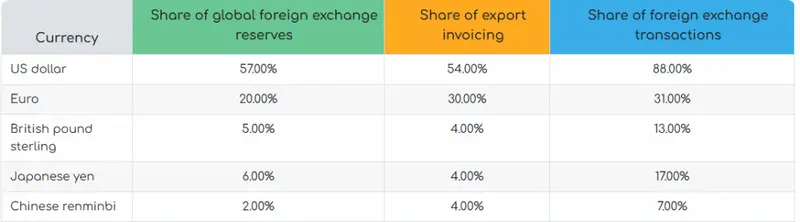

De-dollarization efforts are currently facing substantial and also quite practical limitations despite the ongoing push from countries such as Russia and China. The lack of sufficient assets among BRICS nations represents what appears to be a fundamental obstacle to creating viable United States dollar alternatives.

BRICS expansion has, in recent months, brought new members into the discussions about local currency usage, but reaching any sort of consensus remains somewhat elusive when it comes to actually implementing alternatives to the dollar-based system.

How Will De-Dollarization Affect The Economy?

Digital solutions including, but not limited to, cryptocurrency have been explored as potential pathways for dedollarisation, though Brazil’s assessment at this point suggests that fundamental asset issues cannot be easily overcome.

Galipolo emphasized:

“Digital solutions alone won’t solve the fundamental asset gap problem.”

The realistic timeline for any meaningful de-dollarization appears to be much longer than what proponents might suggest, with United States dollar dominance likely continuing for the foreseeable future and beyond.

Also Read: Take-Two Prices $4.75M Share Offering at $225, Morgan Stanley Ups Target to $265

FAQ: De-Dollarization Questions

What is BRICS trying to do with de-dollarization?

BRICS nations are exploring alternatives to the United States dollar for international trade, but as Brazil’s central bank notes, they currently lack sufficient assets to create a viable BRICS currency.

Why are countries pursuing de-dollarization?

Some nations seek to reduce vulnerability to U.S. sanctions and gain more monetary independence, though practical limitations remain substantial.

De-dollarization remains, at the time of writing, more of a long-term aspiration rather than an imminent reality for BRICS nations, despite their ongoing efforts to develop a BRICS currency and also promote various forms of local currency trading.