Michael Saylor is back with another positive crypto market affirmation. With Bitcoin showing signs of inconsistency in its price action, Saylor confirmed that the market is indeed experiencing a crypto winter. But the latest developments involve Saylor’s new comment about how short this crypto winter is going to be and the reasons why this crypto winter is different from others.

Also Read: Palantir Stock Climbs: Miami Relocation, Valuation in Focus

Saylor: This Crypto Winter Will Not Last Long

Michael Saylor, former CEO of Strategy, has once again shared new comments on the current Bitcoin price action. As Bitcoin encounters strong volatility with its price hitting $69K at the moment, Saylor is positive about the fact that the market is currently encountering a brief crypto winter. Later on, Saylor further shared how this crypto winter won’t last long and will be followed by a prosperous crypto summer.

“Uh, we are in a crypto winter. This is the fifth major drawdown of Bitcoin in the five years since I’ve been in the marketplace. Uh, this is a much milder winter than previous winters. It’ll be shorter than previous winters. It’s going to be followed by a spring and then a glorious summer. So don’t fear.”

Saylor’s Brief Explanation of Bitcoin Surging Soon

When asked about Saylor’s confident stance about the market’s future, the former strategy CEO responded about the strong backing that the sector has been receiving as of late. Elaborating more on that, Saylor shared how the crypto markets are now being backed by the banking sector, an element that was nonexistent before. In addition to this, the formation of digital networks, banking credit networks, and a bitcoin president supporting the domain are some of the happening factors that may help support Bitcoin and the crypto market in the long run.

“The banking sector is supporting Bitcoin much more strongly today than we were four years ago. We’ve got the formation of digital credit networks and banking credit networks. We’ve got the support of the administration and a Bitcoin president. 12 cabinet members that are pro digital assets and pro-innovation. In a single month you see new advances in the digital asset space, which are bringing extraordinary productivity to the economy. And a lot of capital to the asset class. You know, you’re absolutely right when it comes to the banks who have finally started accepting and embracing it….Black Rock, the world’s largest asset manager, is finally pushing hard to get a spot Bitcoin ETF in play, IBIT, and the rest have done depending on what Bitcoin is doing.”

Bitcoin’s Future: Where Is the Asset Heading Towards?

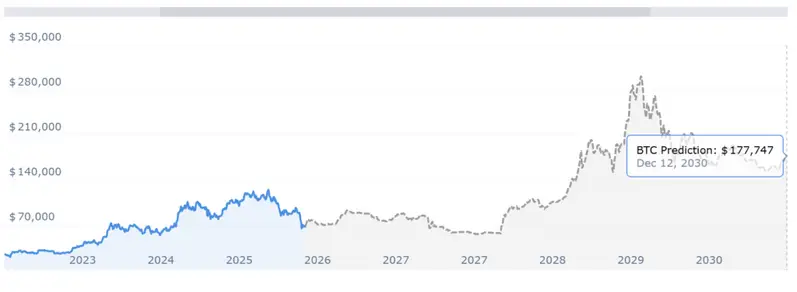

According to CoinCodex BTC stats, Bitcoin may explore a new high of $177K by the year 2030.

“Bitcoin is forecasted to hit $78,065 by the end of 2026 (+14.46% compared to current rates). And $166,372 by 2030 (+143.95%), $968,339 by 2040 (+1,319.85%), and $1.49M by 2050 (+2,086.91%). All values represent end-of-year price estimates according to our models.”

Also Read: India Expands Trade with EU and US, Reshapes BRICS Power Balance