The BNB Foundation just completed its 30th token burn. This operation removed $1.16 billion worth of cryptocurrency from circulation. The crypto token burn is a key shift in the cryptocurrency market. These changes affect BNB’s supply and market stability.

Also Read: Official TRUMP & MELANIA Coins Prediction For Early February 2025

Understanding the BNB Token Burn and Its Impact on Market Volatility

Breaking Down the Burn Numbers

Around 1.6 million BNB tokens were removed in this quarter’s Foundation operations. Interesting, right?

The BNB Foundation said the following in their official announcement:

“Of this total, 1,524,200.95 BNB were eliminated through a combination of the Auto-Burn and Pioneer Burn mechanisms, while an additional 110,000 BNB connected to staked tokens from the BNB Chain Fusion became irretrievable.”

How Does the Auto-Burn Mechanism Work?

There are a lot of aspects to consider when talking about the BNB token burn flow through an automated system. A wide range of market factors in the cryptocurrency market drive calculations. Vast quantities of tokens disappear into a “black hole” address. These sophisticated mechanisms guarantee permanent removal from the ecosystem.

Also Read: Nvidia (NVDA) Stock Projected to Grow 70%, Enter $300B Market

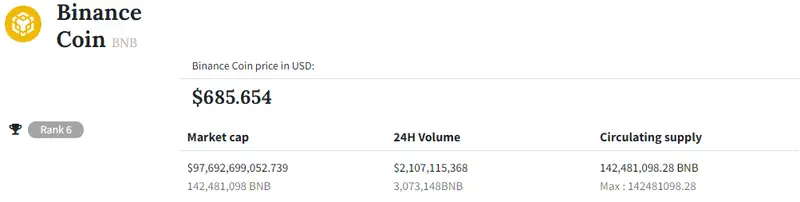

Impact on Token Supply and Future Burns

Following this substantial crypto token burn, somewhere around 142.5 million BNB tokens remain active. Ambitious plans target burning upwards of 42 million more tokens. Quite a few experts see this as a cornerstone of value preservation.

Pioneer Burn Program Innovations

Significant portions of this quarter’s BNB token burn flowed through innovative channels. Well over 110,000 BNB tokens vanished during system updates.

The foundation also stated:

“Validators affected by this transition will be compensated through the anti-black hole plan.”

A wide array of measures ensure the safety of the participants in the ecosystem.

Also Read: Avalanche (AVAX) to Reach $70 This Month: Here’s When

How Do the Burns Change BNB Value?

A wealth of factors in the cryptocurrency market drives these systematic burns. Continuous reductions reshape total supply patterns. Growing numbers of investors track the transparent burning schedule. These established practices strengthen market confidence considerably.