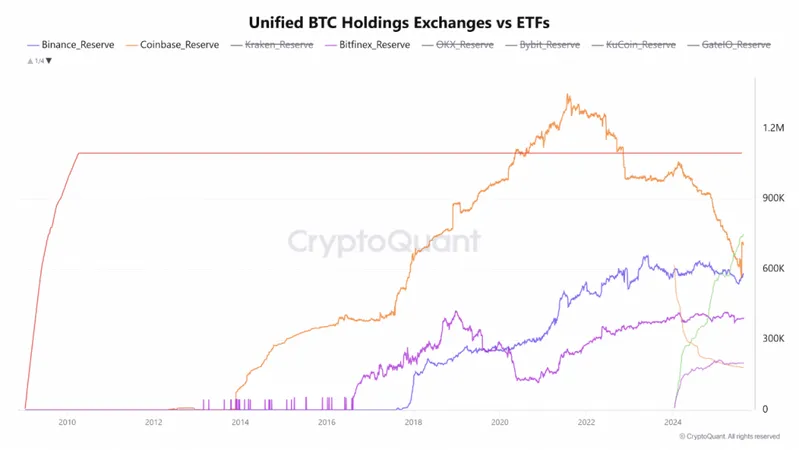

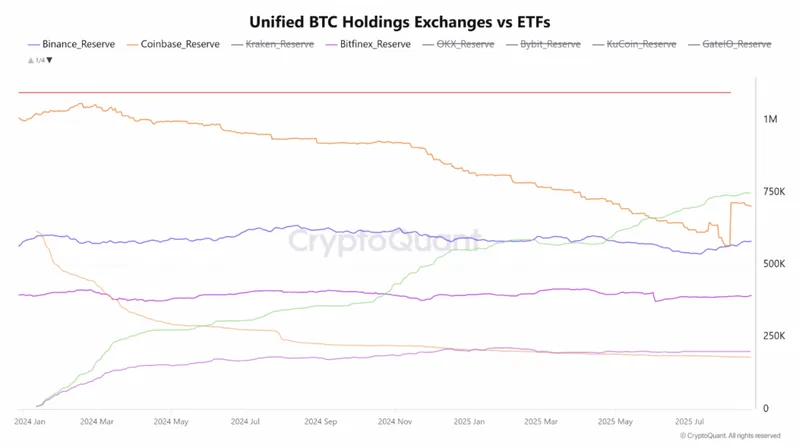

BlackRock flips Coinbase to become the largest Bitcoin holder right now, and the BlackRock Bitcoin holdings have actually reached over 781,000 BTC through its iShares ETF. This historic milestone shows how BlackRock flips Coinbase in the race for Bitcoin custody dominance, and it’s marking a shift from exchange-based storage to institutional investment products.

BlackRock’s iShares ETF Dethrones Exchanges, Becomes Largest Known BTC Holder

— CryptoQuant.com (@cryptoquant_com) August 22, 2025

“Inflows into BlackRock’s ETF signify a fundamental change in market structure. The primary demand driver has shifted from retail-centric exchange accumulation to regulated, institutional-grade… pic.twitter.com/G043uNYpdW

BlackRock’s Bitcoin Holdings Surpass Coinbase Amid Institutional Investment Trends

The moment when BlackRock flips Coinbase represents a fundamental change in Bitcoin custody, and the data shows that BlackRock Bitcoin holdings have been growing rapidly since the ETF launch. At the time of writing, the Coinbase BTC balance has actually declined as institutional money flows into regulated products along with other similar investment vehicles.

CryptoOnchain had this to say:

“Inflows into BlackRock’s ETF signify a fundamental change in market structure. The primary driver has shifted from retail-centric exchange accumulation to regulated, institutional-grade financial products.”

Institutional Investors Drive Market Shift

Bitcoin institutional investors are reshaping how BTC is held and stored, and this shift is actually quite significant. The data reveals that when BlackRock flips Coinbase, it signals broader institutional appetite for regulated Bitcoin exposure. ETF structures that appeal to large-scale investors and institutional players are now overshadowing the Coinbase BTC balance, which was once the industry standard.

Also Read: BlackRock, Fidelity ETFs Dump $422M Ethereum in Massive Selloff

BTC Market Dominance Reaches New Milestone

This custodial shift affects BTC market dominance patterns significantly right now. As BlackRock Bitcoin holdings continue growing, the concentration of Bitcoin within traditional financial products increases even more. The fact that BlackRock flips Coinbase also shows how Bitcoin institutional investors actually prefer regulated vehicles over direct exchange custody, and this trend is being observed across the market.

The transition from exchange custody to ETF holdings represents the maturation of Bitcoin as an institutional asset class, and it’s happening faster than some expected.

Also Read: BlackRock Holds Over 3% of Bitcoin Supply: What It Means