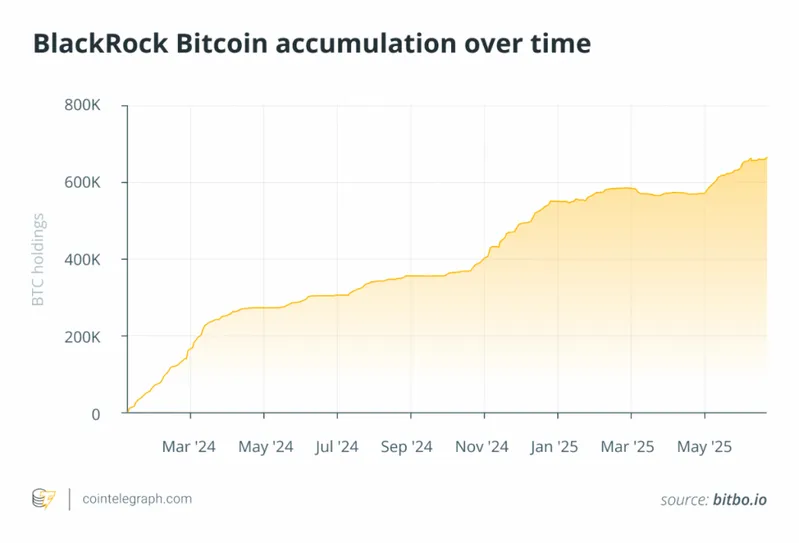

BlackRock’s Bitcoin holdings have reached some pretty crazy levels, and right now the world’s largest asset manager is sitting on over 662,500 BTC through its iShares Bitcoin Trust (IBIT). This is more than 3% of all the Bitcoin that exists, worth around $72.4 billion at current prices. This huge institutional Bitcoin accumulation is changing how we think about crypto investment strategies, and it’s also messing with Bitcoin price volatility in ways nobody really expected.

You can see from the chart how they’ve been steadily buying up Bitcoin since IBIT launched back in January 2024. The growth has been pretty wild.

How BlackRock Bitcoin Holdings Affect Price, Volatility, And Investments

How Fast This All Happened

So here’s the thing – these BlackRock Bitcoin holdings managed to do something that took SPDR Gold Shares over 1,600 trading days to pull off, except they did it in just 341 days. That makes IBIT the fastest-growing ETF ever, which is kind of insane when you think about it.

The BlackRock Bitcoin holdings are now bigger than what most major crypto exchanges hold, and even bigger than some big corporate holders. Only Satoshi’s estimated 1.1 million BTC stash is larger at this point.

This institutional Bitcoin accumulation has been shaking things up. BlackRock said:

“Broader participation improves Bitcoin price discovery, deepens market liquidity and can lead to a more stable trading environment over time.”

Also Read: BlackRock, Grayscale, Fidelity Bought $500M ETH: What’s Going On?

What This Means for Investing

This amount of institutional bitcoin accumulation to me shows that BlackRock now that bitcoin is good enough to go into (regular) portfolios. They are fine with the price volatility of Bitcoin because they think the potential upside gives rise to the, and they are counting on the fact that any more institutions get in, Bitcoin will become more stable.

BlackRock suggests crypto investment strategies with just 1% to 2% Bitcoin in traditional 60/40 portfolios. They like Bitcoin because there’s only ever going to be 21 million of them, and they see it as a way to hedge against the dollar losing value.

BlackRock called this trend:

“Supercharged by demographic tailwinds, especially as younger investors gain influence.”

They also said Bitcoin gives:

“Additive sources of diversification.”

Also Read: BlackRock to File Hedera (HBAR) Spot ETF by Monday, Market Braces

The Downside and Worries

These massive BlackRock Bitcoin holdings bring up some uncomfortable questions about whether Bitcoin is still decentralized. Even though Bitcoin’s technology is still decentralized, most people now buy and hold it through centralized companies like BlackRock.

These crypto investment strategies became possible because of regulatory changes, but there are still problems. Commissioner Caroline Crenshaw said:

“Muddy waters and reactive enforcement that stifles innovation.”

This doubt does not apply only to crypto investment strategies related to Bitcoin, but BlackRock success demonstrates that institutions desire exposure to crypto as long as the rules are defined. These large institutional transactions along with all other market moving factors affect the volatility we are currently experiencing in the price of Bitcoin.