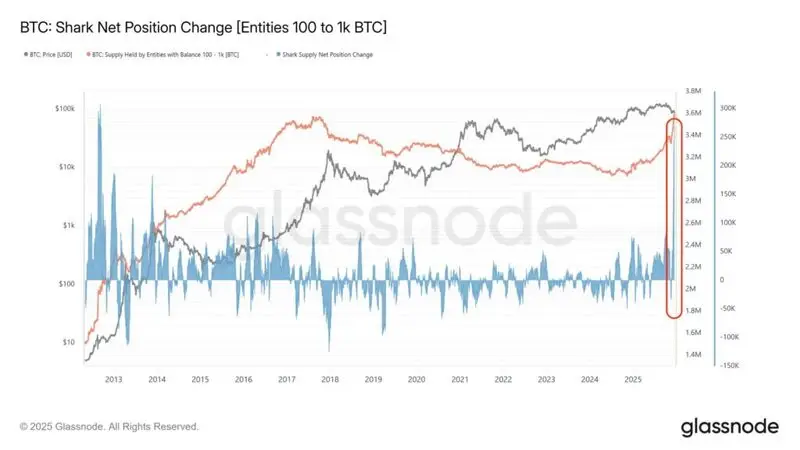

According to Glassnode data, Bitcoin (BTC) whales have purchased 269,822 BTC, worth more than $23 billion, over the last 30 days. The development marks the largest purchase made by whales in 30 days over the last 13 years. BTC faced a substantial price correction over the last few months, and large wallets seem to be pouncing on the discounted prices. Given the increased whale purchases, let’s discuss if BTC’s price will rebound over the coming weeks.

Will Whale Purchases Push Bitcoin’s Price?

Whale movements are a key driver for Bitcoin’s (BTC) price. Large wallets seem to be buying the dip, which could signal an incoming trend reversal. Many industry experts anticipate BTC’s price to take off in 2026. Grayscale believes BTC has diverged from its 4-year cycle and now follows a 5-year path. This means that BTC could climb to a new peak in 2026. Other factors that could push BTC’s price include lower interest rates and pro-crypto legislation in the US.

Bernstein also presents a similar outlook for Bitcoin (BTC). According to the financial institution, BTC will breach the $150,000 mark in 2026 and eventually hit $200,000 in 2027. Berntein also believes BTC is currently following a 5-year cycle.

While Grayscale and Bernstein are optimistic in their 2026 outlook, Barclays presents a rather bearish prediction. Barclays believes the crypto market will face further challenges in 2026. The firm cites decreased spot trading volumes and low demand for its bearish outlook.

Also Read: Michael Saylor Hints at Buying More Bitcoin as BTC Trades at $89,000

It is unclear how the crypto market will behave in the coming months. Macroeconomic factors, such as slow economic growth and high jobs figures, may lead to prolonged market bearishness. However, if inflation numbers go down, the crypto market may see renewed interest. Currently, investors are pouring funds into risk-free assets, such as gold and silver. This trend could change over the coming months.