Bitcoin‘s global money supply has actually reached 1.7% of worldwide money supply right now, and this marks a pretty significant milestone for the digital asset. This achievement comes as Fed rate cut impact drives both institutional and also retail interest toward cryptocurrency market alternatives. The timing coincides with Bitcoin adoption growth reaching unprecedented levels, while crypto investment volatility remains a key concern for market participants at the time of writing.

Bitcoin Surges Amid Fed Rate Cut And Rising Market Risks And Adoption

River’s analysis shows Bitcoin global money supply representation at 1.7% against $138 trillion in combined fiat currencies and hard money assets. Bitcoin’s current market cap of $2.4 trillion is being weighed against $112.9 trillion in fiat currencies along with $25.1 trillion in hard money assets like gold. The ratio currently sits around 1.66% with Bitcoin at approximately $2.29 trillion right now.

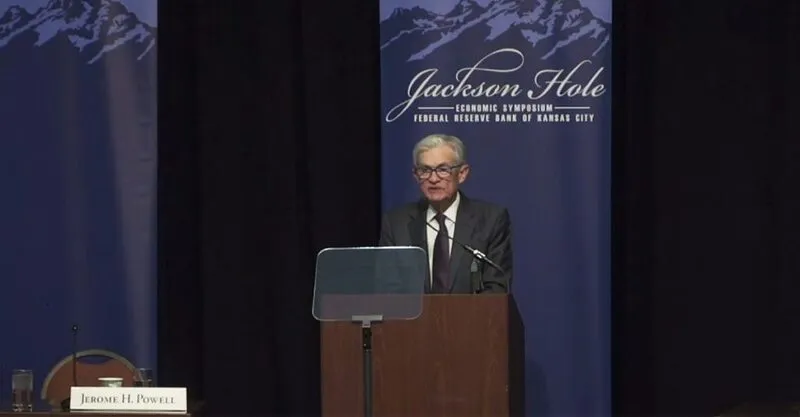

Jerome Powell stated at Jackson Hole:

”Policy adjustments may be warranted given current inflation and labor market conditions.”

Fed Rate Cut Impact Creates Market Euphoria

The Fed rate cut impact actually pushed Bitcoin above $116,000 following Powell’s dovish comments on Friday. Santiment is warning about excessive market euphoria, noting that social media mentions of Federal Reserve keywords have reached 11-month highs. This cryptocurrency market risks scenario potentially signals some overheated conditions in the market.

Santiment had this to say:

”Excessive euphoria around rate cut expectations could indicate overheated conditions.”

Some traders are predicting massive flows into crypto, with expectations of 10x to 50x altcoin explosions, while others warn about short-term pressure from recession fears.

Also Read: The Latest Bitcoin Crash: Who To Blame?

Bitcoin Adoption Growth Accelerates Despite Concerns

Bitcoin adoption growth is benefiting from central bank money printing policies that are driving investors toward hard assets right now. Digital assets typically appreciate during monetary expansion periods, which creates favorable conditions for Bitcoin global money supply expansion. However, crypto investment volatility remains elevated as traders debate the long-term implications.

Market participants remain divided on cryptocurrency market risks versus opportunities at this point. Historical patterns actually suggest caution when single narratives dominate discussions around Fed rate cut impact. The current focus on monetary policy has overshadowed other factors that typically influence Bitcoin global money supply metrics and broader market sentiment.

Also Read: Trillions of Dollars Could Flow Into Bitcoin, Ethereum, Cardano, SHIB

Central bank money printing continues to drive investors toward hard money alternatives, benefiting both Bitcoin and gold simultaneously. Even with some concerns about crypto investment volatility, the trend toward Bitcoin adoption growth appears to be accelerating across various sectors.