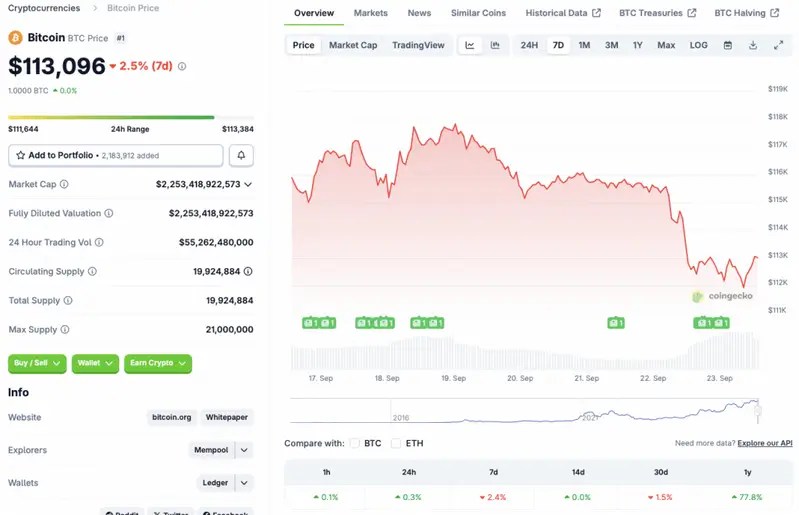

The cryptocurrency market may be stabilizing as Bitcoin (BTC) reclaims the $113000 mark after a slight rally. BTC faced a steep correction over the weekend, falling from the $117000 price level to $111000 earlier today. However, the asset seems to be recovering and entering a consolidation phase. According to CoinCodex data, Bitcoin (BTC) has experienced a 0.3% rally in the daily charts and no change in the 14-day charts. On the other hand, the asset is down 2.4% over the last week and 1.5% over the previous month.

Will Bitcoin Continue Its Rally Beyond $113000?

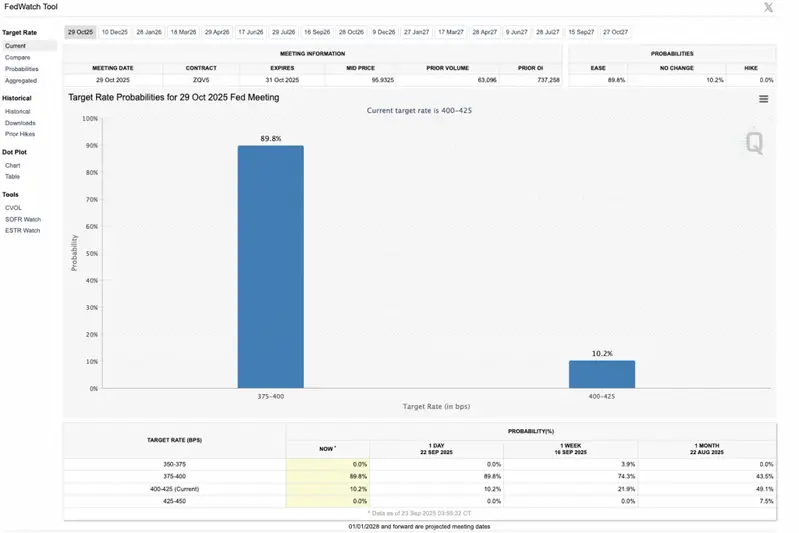

The recent market dip was likely caused by investor worry around the Federal Reserve’s monetary policy stance. Federal Reserve Chair Jerome Powell is scheduled to deliver a speech later today. Powell’s speech may hold clues for what the Fed has in store for the coming months. Bitcoin (BTC) and the larger crypto market may be taking a step back before making any big movements.

There is a chance that the Federal Reserve will take a dovish stance, given that it recently rolled out its first interest rate cut of 2025. Bitcoin (BTC) and other cryptocurrencies experienced slight price rallies before facing a correction this week. According to CME FedWatch, there is an 89.8% chance that the Federal Reserve will announce another 25 basis point interest rate cut in October. Another rate could lead Bitcoin’s (BTC) price to hit a new all-time high.

Additionally, October is often a bullish month for the crypto market, with many calling it “Uptober,” while September is usually considered bearish. The market could follow the historical pattern and see another breakout next month. Coupled with a possible interest rate cut, we could see another market-wide rally. Bitcoin (BTC) could hit a new peak if market conditions are ripe.

Also Read: Deutsche Bank: Central Banks May Buy, Hold Bitcoin by 2030

However, there is also a chance that the Federal Reserve will take a hawkish stance. We could see volatility driven by global macroeconomic trends. Bitcoin (BTC) could face struggles under such circumstances.