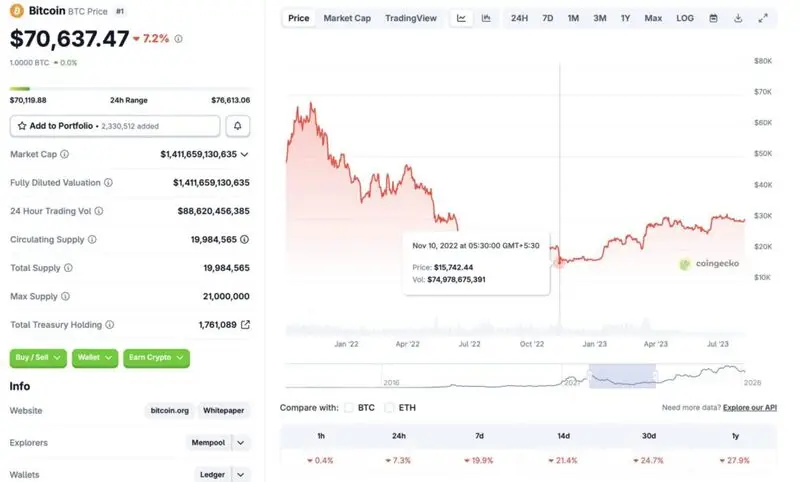

Bitcoin’s (BTC) latest price crash is undoubtedly worrying. However, early crypto adopters will know that this not BTC’s first time facing a steep correction. BTC last faced a big dip in November 2022, soon after the collapse of FTX. The original crypto fell to the $15,000 price level about a year after hitting a new all-time high. However, Bitcoin (BTC) climbed to over $100,000 in December of 2024, just about two years later. Hence, the current market crash should not scare you. Let’s discuss how low BTC may go this time.

How Low Will Bitcoin’s (BTC) Price Go In This Crash?

Investment firm Stifel believes Bitcoin (BTC) could fall as low as $38,000. The firm cites previous cycles, tighter Federal Reserve policy, and slow US crypto legislation. However, the highlight is the shrinking liquidity. The dip in liquidity seems to be the reason behind the steep price correction.

Bitcoin (BTC) falling to $38,000 could lead to substantial losses for several companies and firms. Bitcoin treasuries became a thing over the last year, and all those companies could see major losses of BTC continues its current trajectory.

While Stifel anticipates Bitcoin (BTC) to fall to $38,000, other financial institutions are quite bullish on BTC’s price for 2026. Grayscale and Bernstein both claim that BTC could be following a 5-year path. This means that BTC could hit a new all-time high in 2026, five years after its 2021 all-time high. However, Bitcoin’s (BTC) current trajectory does not inspire confidence.

Also Read: Strategy (MSTR) Stock’s 52-Week Low: Is There Still Hope for BTC Plan?

It is unclear how the market will react over the coming months. We have a new Federal Chair, Kevin Warsh, coming in, and many anticipate him to cut rates first thing in office. A rate cut could potentially provide some cushioning to Bitcoin’s (BTC) falling prices. However, the liquidity crunch is a major worry that could worsen the current situation.