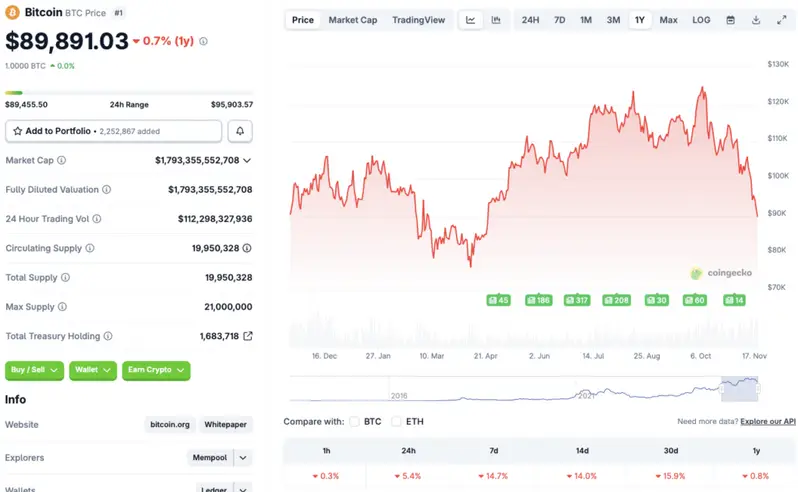

The cryptocurrency market crash has deepened, with Bitcoin falling to the $89000 price level for the first time in nearly seven months. According to CoinGecko’s Bitcoin data, BTC is down by 5.4% in the last 24 hours, 14.7% in the last week, 14% in the 14-day charts, and 15.9% over the previous month. BTC is also down by 0.8% since November 2024, wiping out all gains made in the last year. Let’s discuss how much lower BTC’s price can go.

Will Bitcoin Go Lower Than $89000?

The crypto market is most likely repricing the low expectations of another interest rate cut in 2025. Moreover, Federal Reserve Chair Jerome Powell’s cautionary October speech may have further spooked investors away from risky assets. Bitcoin (BTC) and the larger crypto market are probably reacting to macroeconomic trends.

Another factor impacting the crypto market is the ETF market outflows. Bitcoin (BTC) and Ethereum (ETH) ETFs have seen substantial outflows over the last month. ETFs have played a major role in Bitcoin’s (BTC) price movements this cycle. A dip in ETF inflows has had a massive impact on BTC’s price.

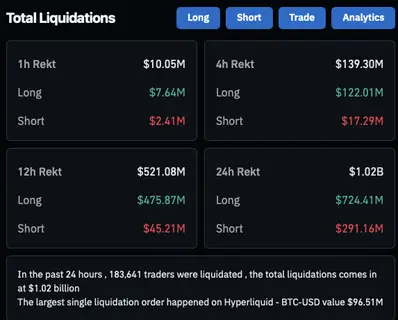

The last 24 hours have pulled the market even further down. According to CoinGlass data, the crypto market faced $1.02 billion worth of liquidations in the last 24 hours.

Also Read: Bitcoin’s Pullback Looks Almost Complete: Here’s the Zone

There is a chance that the market will rebound over the coming weeks. Given the low prices, investors could buy the dip. However, geopolitical stress and an overall risk-off sentiment could lead to Bitcoin’s (BTC) price falling further. Some have even predicted the original crypto to dip to the $56,000 price levels. The crypto market is hot with volatility at the moment, and prices could pivot in either direction. How things unfold is yet to be seen.