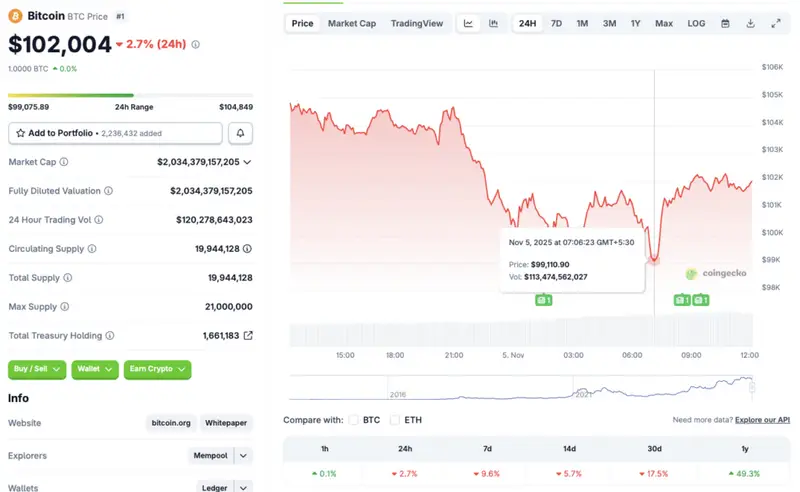

The cryptocurrency market crash continues to bleed investors. According to CoinGlass, nearly $1.8 billion was liquidated from the crypto market in the last 24 hours. Bitcoin (BTC) briefly fell to $99,110 earlier today, but has since recovered the $102,000 price level. CoinGecko data shows that Bitcoin’s price has seen a crash of 2.7% in the last 24 hours, 9.6% in the last week, 5.7% in the 14-day charts, and 17.5% over the last month. The current market situation has led to a substantial rise in investor fears. Let’s discuss why Bitcoin (BTC) falling below $100,000 should not scare you.

Bitcoin’s Price Crashing Below $100,000 Could Be a New Opportunity

The latest market correction is undoubtedly one of the most significant in recent memory. However, it is far from being the worst crash ever. In 2022, Bitcoin’s (BTC) price fell to the $15,000 price level after breaching the $60,000 price level in 2021. Since 2022, BTC has achieved multiple milestones and new price peaks. We may most likely experience a similar pattern this time around.

Bitcoin (BTC) is the best-performing financial asset of the last decade and a half. The current price dip allows people to purchase more Bitcoin (BTC) at lower prices. Many industry experts anticipate BTC’s price to hit never-before-seen levels over the coming years. Binance founder Changpeng Zhao, ARK Invest CEO Cathie Wood, etc., expect BTC to eventually reach the $1 million mark. If successful, BTC’s dip below the $100,000 mark is just a little bump on a long and winding road.

Also Read: Top 3 Crypto Dips To Buy Now That Bitcoin Is At $101K

Bitcoin (BTC) will most likely rebound over the coming weeks. According to CoinCodex analysts, BTC will climb to a new all-time high of $142,263 on Dec. 25, 2025. Hitting $142,263 from current price levels will entail a rally of about 39.4%, paving the way for healthy gains.