The Bitcoin price prediction shows bullish momentum right now as cryptocurrencies surge following President Trump’s Israel Iran ceasefire announcement and also growing Fed rate cut effect expectations. Bitcoin rebounded to $106,000 while Ethereum price surge reached $2,408, and also XRP price forecast indicates continued gains across major digital assets at the time of writing.

Also Read: Metaplanet Buys Another 1,111 Bitcoin Worth $111M; BTC Eyes $117K

Bitcoin Price Prediction, Crypto Surge Amid Israel Iran Ceasefire & Fed Rate Cuts

Bitcoin price prediction models are being revised upward right now as the cryptocurrency recovered swiftly from Sunday’s dip below $98,500. The digital asset reclaimed $106,000 following geopolitical developments and also monetary policy shifts.

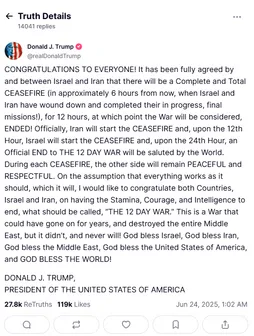

President Trump announced the ceasefire agreement on Truth Social:

“CONGRATULATIONS TO EVERYONE! It has been fully agreed by and between Israel and Iran that there will be a Complete and Total CEASEFIRE (in approximately 6 hours from now, when Israel and Iran have wound down and completed their in progress, final missions!), for 12 hours, at which point the War will be considered, ENDED!”

Fed Rate Cut Effect Boosts Bitcoin Price Prediction

The Fed rate cut effect is becoming increasingly apparent in cryptocurrency markets right now. According to CME Group’s FedWatch tool, the probability of maintaining current 4.25% rates through November dropped to 8.4% from 17.1% weekly.

Bitcoin price prediction analysts note that odds of rates falling to 3.75% or lower by November increased to 53% from 38%. This shift supports bullish sentiment across digital assets as investors seek alternatives to traditional fixed-income investments at the time of writing.

Israel Iran Ceasefire Impact on Crypto Markets

The Israel Iran ceasefire impact extended beyond Bitcoin to other major cryptocurrencies right now. Ethereum price surge reached 9% gains to $2,408, recovering from weekend losses. Solana jumped 11% while also Dogecoin rose 10%.

XRP price forecast improved significantly with 9% daily gains alongside Cardano’s similar performance. The broad rally demonstrates how the Israel Iran ceasefire impact affects the entire digital asset ecosystem at the time of writing.

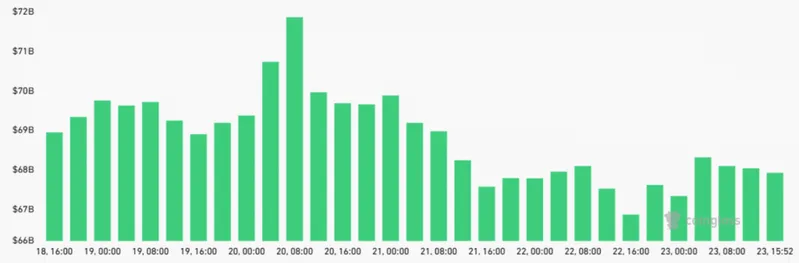

Mining Hashrate and Market Stability

Bitcoin’s hashrate declined 8% between Sunday and Thursday, falling to 865.1 million TH/s from 943.6 million TH/s. This raised concerns about regional mining disruptions affecting Bitcoin price prediction models right now.

"Where is all the hashrate coming from?"

— cbspears ◉ (@cbspears) May 14, 2025

Iran. ~2 GIGAWATTS ⚡️⚡️ (and most of it's illegal)@AsILayHodling dropped a BANGER feature story in @blockspacepod this morning.

Wild takeaways:

→ Iranians are actively skirting sanctions with Bitcoin mining

→ There's over 3K flared… pic.twitter.com/xKEPxAuw58

Daniel Batten addressed hashrate concerns:

“No this is not because Iran is secretly mining large swathes of Bitcoin using nuclear energy. Firstly, drops like this are common (see chart below) and are more likely due to ERCOT curtailment (being paid to shed load, or getting a price signal it’s uneconomical to mine).”

No this is not because Iran is secretly mining large swathes of Bitcoin using nuclear energy. Firstly, drops like this are common (see chart below) and are more likely due to ERCOT curtailment (being paid to shed load, or getting a price signal it's uneconomical to mine).… https://t.co/AxX3poncZ6 pic.twitter.com/XnL4YGaMCl

— Daniel Batten (@DSBatten) June 23, 2025

Also Read: Saylor Signals MicroStrategy Bitcoin Buy, Predicts $21M by 2046

Market Liquidations and Future Outlook

Crypto liquidations totaled $491 million over 24 hours, with short positions accounting for $376 million. Bitcoin led liquidations at $161 million, followed by Ethereum at $140 million.

The Ethereum price surge and also XRP price forecast improvements suggest sustained momentum right now. Prediction markets show 79% probability Bitcoin maintains above $100,000 through June 27, reinforcing positive Bitcoin price prediction sentiment at the time of writing.

The combination of Israel Iran ceasefire impact and also Fed rate cut effect creates favorable conditions for continued cryptocurrency growth across Bitcoin, Ethereum, XRP, and other major digital assets.