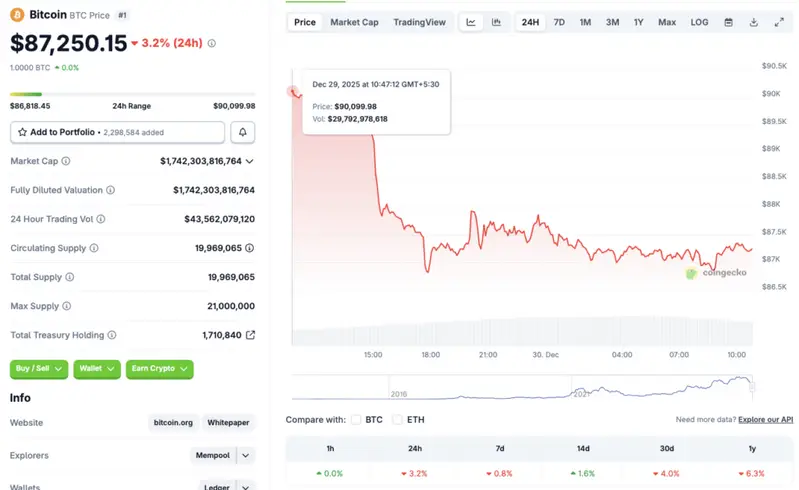

Bitcoin (BTC) climbed to the $90,000 price level on Monday, Dec. 29, 2025, showing signs of a trend reversal. BTC’s rally was also complimented by a dip in gold prices. However, the rally seems to have been short-lived as the asset faced a price correction in the last 24 hours, falling to the $87,000 level. According to CoinGecko, Bitcoin is down 3.2% in the last 24 hours and 4% over the previous month. Let’s discuss if Bitcoin will maintain this level following the price dip, or will the asset face further corrections.

Will Bitcoin Maintain This Level, Or Will Its Price Dip Further?

Bitcoin (BTC) seems to have found some footing at the $87,000 price level. The asset will likely stabilize around its current price level. BTC rebounded from the $86,000 mark twice in the last 24 hours. This could mean that BTC’s price is consolidating around the $87,000 mark.

Monday’s price rally was likely a dead cat bounce for Bitcoin (BTC). Investors may be testing the waters ahead of the new year. Gold prices fell by 1.5% on Monday, which was another signal that investors considered dipping their toes back into risky assets. However, today’s crypto price correction shows that the market is still not ready to pour money into risky assets.

Bitcoin (BTC) will likely maintain its current price level over the coming weeks. The crypto market will likely not see any positive price action until larger macroeconomic conditions improve.

However, despite the bearish conditions, CoinCodex analysts anticipate Bitcoin (BTC) to rally over the coming days. The platform predicts BTC will trade at $95,000 on Jan. 3, 2026, eventually breaching the $100,000 price level on Feb. 15, 2026.

Also Read: Strategy (MSTR) Stock Prediction: Will Buying BTC Dip Pay Off?

Bitcoin’s (BTC) price could pivot in any direction over the coming weeks. The market is still fragile, hence, it is more likely that prices will remain steady around current levels for at least the next week.