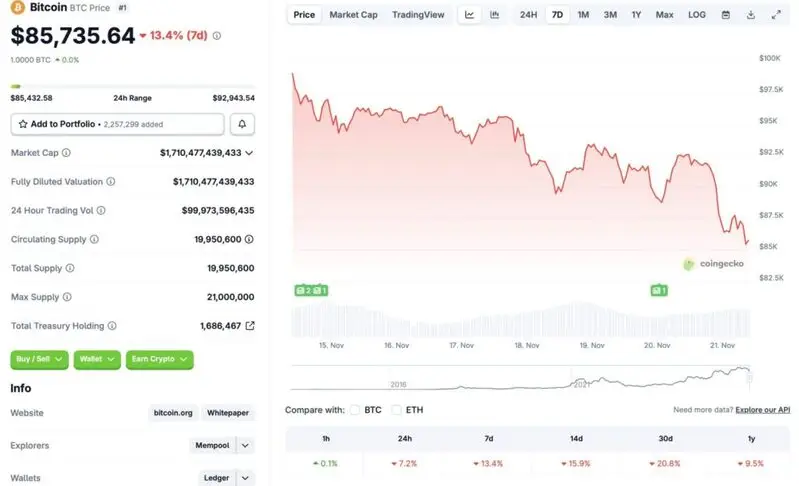

Bitcoin (BTC) is facing one of its most significant price crashes of this year, falling to the $85,000 price point. The asset is currently down to its lowest price level in seven months. According to CoinGecko data, BTC is down by 7.2% in the last 24 hours, 13.4% in the last week, 15.9% in the 14-day charts, and 20.8% over the previous month. BTC has also lost all gains made over the last year, falling 9.5% since November 2024. Let’s discuss how long the current bear market may last.

When Will Bitcoin Recover From Its Latest Crash?

Bitcoin (BTC) and the larger crypto market have taken a massive beating over the last month and a half. According to CoinGlass, the crypto market saw about $950 million worth of liquidations in the last 24 hours. The global crypto market cap has dipped 6.3% in the last 24 hours to $3.03 trillion.

Bitcoin’s (BTC) ongoing price crash is likely due to rising macroeconomic uncertainty in the US. Moreover, the September jobs data showed a higher-than-expected unemployment rate. Both factors have led to a diminished chance of another interest rate cut in 2025. Moreover, Bitcoin (BTC) whales have sold a substantial amount of coins. All these factors have together pulled the market to new depths. The market crash is raising serious concerns about another crypto winter.

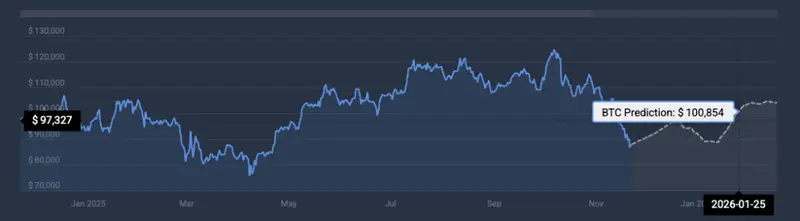

Bitcoin (BTC) may face further price dips over the coming months. Given the uncertain macroeconomic conditions, investor sentiment may not rebound anytime soon. If things improve by early 2026, the Federal Reserve may decide on another interest rate cut next year. Such a development could propel Bitcoin (BTC) back to the $100,000 mark.

Also Read: Bitcoin Price May Suffer in 2026, Says Economist: How True Is This?

CoinCodex analysts also anticipate Bitcoin (BTC) to reclaim the $100,000 next year. The platform predicts BTC will trade at $100854 on Jan. 25, 2026.