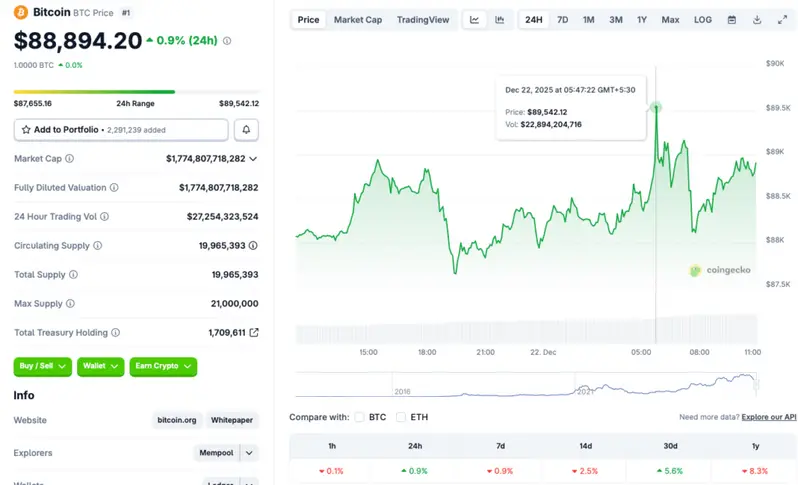

Bitcoin (BTC) appears to be facing substantial resistance at the $ 90,000 price level. The original crypto climbed to the $89,542 mark earlier today, Dec. 22, 2025, but has since fallen back to the $88,000 level. According to CoinGecko’s Bitcoin data, BTC has rallied 0.9% in the last 24 hours and 5.6% over the previous month. However, the asset remains down by 0.9% over the previous week, 2.5% in the 14-day chart, and 8.3% since December 2024. BTC’s price dip over the last few months has been concerning. However, the asset seems to be consolidating around the $87,000-$88,000 price level.

Can Bitcoin (BTC) Reclaim $90,000 Before 2026 Starts?

BTC has been on a bearish path since hitting an all-time high of $126,000 in October. October is historically a bullish month, but 2025 seems to have taken a different path. The downtrend started after the Federal Reserve rolled out an interest rate cut in October, another bullish development. However, the market responded bearishly as investors did not anticipate another rate cut in 2025. Things turned around in December, as the Federal Reserve announced yet another interest rate cut. Bitcoin (BTC) and the larger crypto market remained bearish even after the December rate cut. The current lackluster performance is likely due to macroeconomic uncertainties.

It is unclear if Bitcoin (BTC) will enter a rally anytime soon. Market participants seem to be diverting their funds into safe havens such as gold and silver, both of which have hit new peaks. Gold and silver hitting new all-time highs could be a signal that investors are not interested in risky assets, such as cryptocurrencies, at the moment.

Also Read: This Bitcoin Miner Turned Less Than $100 Into $271,000

However, things could change very soon. The crypto market could see increased inflows, and Bitcoin (BTC) could reclaim the $90,000 price level by early 2026.