The cryptocurrency market seems to be making a recovery from its recent dip. Bitcoin (BTC) has reclaimed the $112,000 price level after briefly falling below $110,000. Binance Coin (BNB) seems to be following the market recovery as well. CoinCodex data shows that BNB’s price has rallied 1.3% in the last 24 hours, 0.7% in the weekly charts, 1.6% in the 14-day charts, 5.2% in the monthly charts, and 61.6% since late August 2024. BNB may finally breach the $900 mark with its latest momentum.

Can Binance Coin’s Recovery Push It To The $900 Mark?

BNB recently climbed to an all-time high of $899.77 on Aug. 22. The asset was just inches away from breaching the $900 mark. If BNB reclaims its all-time high price level, there is a high chance that it will go beyond the $900 mark.

The latest market recovery could be due to macroeconomic tailwinds. The Federal Reserve recently held its Jackson Hole meeting. The central bank seems to be unwinding the quantitative tightening. The move has led to investors taking on more risks. There is also a high probability that the Federal Reserve will cut interest rates in September. A rate cut may further push crypro assets, such as BNB.

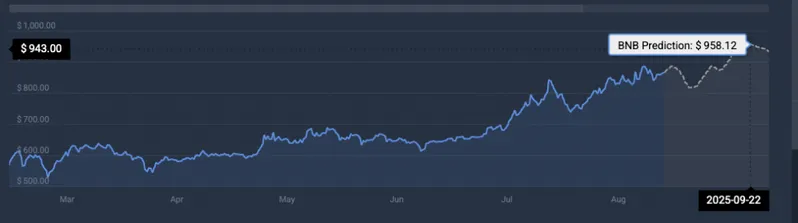

According to CoinCodex analysts, Binance Coin (BNB) will continue its recovery trajectory over the coming weeks. The asset may face a price dip in early September to around $820, before rallying again. The platform anticipates BNB to hit an all-time high of $958.12 on Sept. 22. CoinCodex further anticipates BNB to breach the $1000 mark in November of this year.

Also Read: BNB Price: $1000 Incoming? Traders Should Not Ignore This Forecast

There is also a chance that BNB will face a correction in September. September has historically been a bearish month for Bitcoin (BTC). The market could suffer if we follow the same pattern in 2025.