Bargain stocks with high growth potential have caught the attention of many investors right now, especially with the Nasdaq tumbling about 13% into correction territory. This market dip has opened up some pretty interesting buying opportunities for patient investors who are actively looking for cheap stocks to invest in. While there’s definitely some ongoing concerns about a possible recession and also those potential tariff impacts that are weighing on the market, several undervalued companies with solid fundamentals and promising growth stories stand out in this rather unpredictable environment.

Also Read: BNB Price Surge: $580 Breakthrough with 6.19% Rise – Key Drivers

Top 3 Undervalued Stocks to Consider

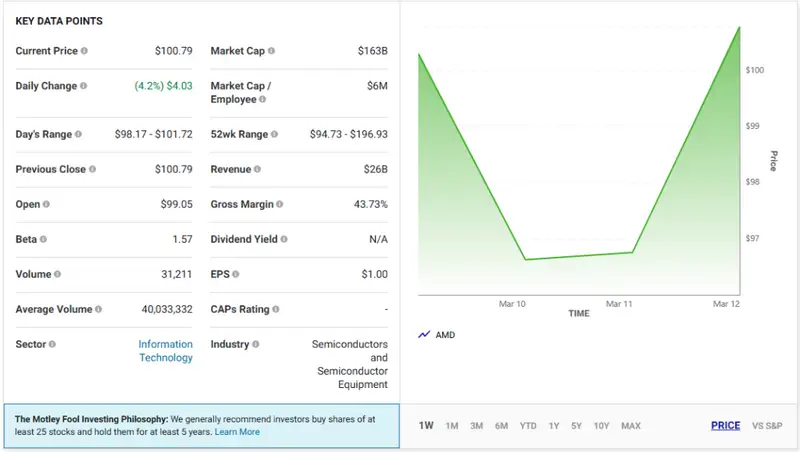

1. AMD: AI Chipmaker at a Discount

Advanced Micro Devices (NASDAQ: AMD) has taken a significant hit lately, with shares currently trading at $100.79, which is more than 50% below the 52-week high of $196.93. This particular bargain stock is selling for approximately 21 times forward earnings right now, even though the company continues to show some pretty impressive business momentum.

Matt Frankel, market analyst, stated:

AMD’s data center business nearly doubled revenue year over year in 2024, and the PC chip business grew rapidly as well.

AMD’s adjusted EPS grew by about 25% last year, and management is also projecting around 30% year-over-year revenue growth for Q1 2025. The long-term outlook for this company remains quite positive with the data center industry expected to grow by an impressive 140% by 2030, positioning this growth stock for 2025 as a potential winner as it continues to capitalize on emerging AI trends and innovations.

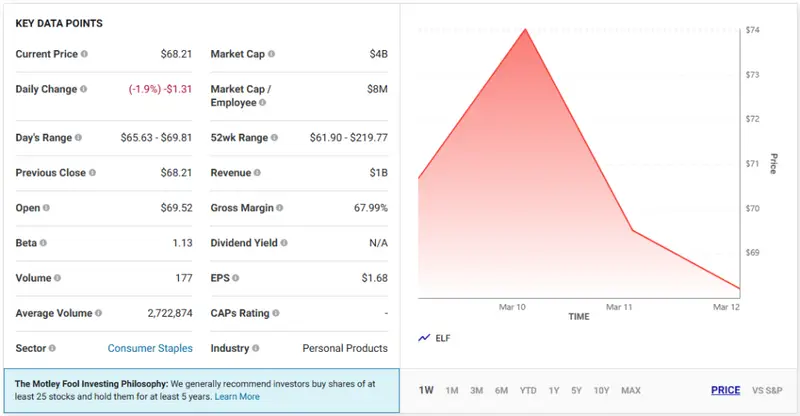

2. e.l.f. Beauty: Cosmetic Leader on Sale

e.l.f. Beauty (NYSE: ELF) shares have fallen dramatically over the past several months, with the stock price dropping by nearly two-thirds from its peak to around $68.21. This particular bargain stock now offers a pretty attractive valuation with a forward P/E of approximately 23 and a PEG ratio of just 0.5, which generally indicates an undervalued investment opportunity.

Despite recently lowering its quarterly revenue growth forecasts to just 1-2% because of some challenging industry headwinds and those TikTok ban concerns, e.l.f. Beauty has demonstrated a remarkable ability to capture market share in the mass-merchant cosmetics segment. The company’s expansion into skincare has been quite successful so far, and there are still significant growth opportunities in fragrance and also international markets.

Also Read: Dogecoin: $550 Worth Of DOGE Becomes $1 Million Today

The “lipstick index” phenomenon suggests that cosmetics typically remain pretty resilient even during economic downturns, which further strengthens the investment case for this undervalued stock. Expected shelf space gains at major retailers like Target later this year should help drive future growth for this promising growth stock for 2025.

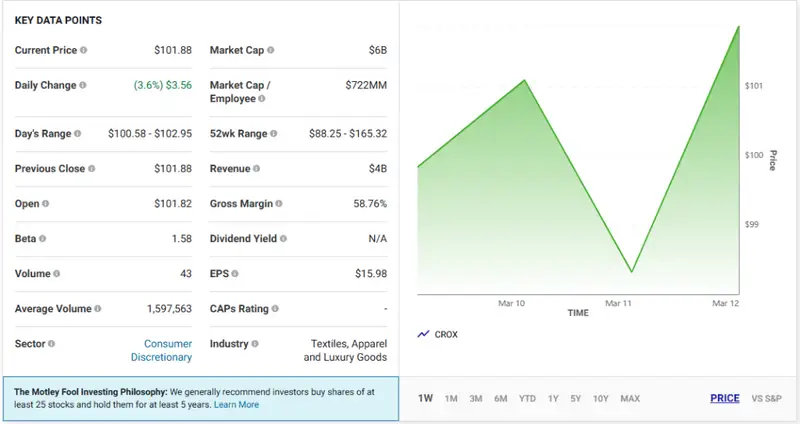

3. Crocs: Footwear Giant in the Bargain Bin

Crocs (NASDAQ: CROX) shares have fallen by approximately 20% over the past year to about $101.88, resulting in an unusually low forward P/E under 8. This bargain stock is trading well below its 52-week high of $165.32, presenting what could be an interesting opportunity for value investors.

While the namesake brand continues to perform well in international markets, Crocs has faced some challenges with its HeyDudes acquisition. However, recent quarters have shown signs of stabilization with flat year-over-year sales after previous periods of decline. The company’s strategic focus on the young female demographic has yielded some pretty impressive results so far.

Crocs generated around $923.2 million in free cash flow in 2024, which provides substantial financial flexibility to reduce debt, repurchase undervalued shares, and also invest in various growth initiatives. The core brand continues expanding through international growth, product innovation, and the development of its sandal category.

Also Read: EU’s $28B Counter-Tariffs Challenge U.S. as MiCA Reshapes Crypto Banking

These three bargain stocks with high growth potential offer some compelling opportunities for investors at the moment. Their strong fundamentals, clear growth strategies, and rather attractive valuations following the recent market declines have positioned them well for potential outperformance when market conditions eventually stabilize.