The US Dollar’s collapse warning from Bank of America comes as the dollar actually suffers a dramatic 9% year-to-date decline, which is triggering concerns about currency stability right now. The Bank of America prediction highlights growing global trade uncertainty and also mounting investor anxiety over trade policy impacts. This US Dollar collapse warning reflects broader concerns about de-dollarization trends and potential global financial instability that are being felt across markets.

De-Dollarization Trend Sparks Global Financial Instability Fears

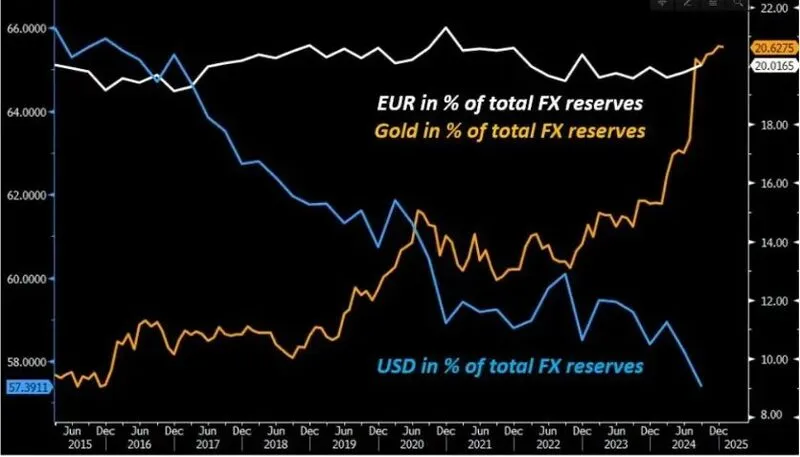

The de-dollarization trend has actually accelerated as Bank of America reported neutral dollar flows amid global trade uncertainty. This shift represents a significant change from the dollar’s traditional safe-haven status, with real money investors showing mixed sentiment toward the greenback at the time of writing.

Bank of America analysts stated:

“Bank of America reported that its proprietary dollar flows have turned neutral amid growing global trade uncertainty and unclear consequences for the greenback following recent post–Liberation Day developments.”

This neutral stance signals a significant shift in dollar reserve currency risk perception right now. The de-dollarization trend is becoming more pronounced as countries are seeking alternatives to dollar-denominated assets, which is contributing to global financial instability concerns. The US Dollar collapse warning cannot be ignored given these shifting dynamics that are happening.

Also Read: What Does JP Morgan Say About De-Dollarization?

Dollar Reserve Currency Risk Escalates

The dollar reserve currency risk has intensified as the U.S. Dollar Index declined more than 9% year-to-date. This US Dollar collapse warning comes as investors grapple with potential long-term impacts of trade policies and monetary shifts that are occurring.

Bank of America’s analysis reveals that recent dollar weakness reflects both portfolio adjustments and mounting investor anxiety. The global financial instability stemming from dollar weakness has created ripple effects across international markets along with other economic pressures.

Analysts at Bank of America noted:

“The recent decline in the U.S. Dollar Index — now down more than 9% year-to-date — reflects not only portfolio adjustments in response to evolving monetary policy but also mounting investor anxiety over the potential lagged impact of trade actions.”

Also Read: These 3 Things That May Accelerate The De-Dollarization Move

The Bank of America forecast is a rude wake-up call of the US Dollar collapse warning more than just market volatility, it is in fact a realization that the world is facing a fundamental change in the global currency landscape. With global financial chaos deepening and dollar de-dollarization continuing, the dollar reserve currency risk is subject to unprecedented challenges that may radically change international finances.