The axCNH stablecoin represents China’s first licensed offshore yuan-pegged digital asset, and it was launched to challenge U.S. dollar dominance in the $300 billion global stablecoin market. This yuan-pegged stablecoin helps facilitate cross-border payments within the Belt and Road Initiative while also advancing digital yuan adoption across participating economies.

Exploring AxCNH’s Role in Global Trade, Cross-Border Payments, and Digital Yuan Adoption

AnchorX officially launched the axCNH stablecoin on September 17, 2025, at the 10th Belt and Road Summit in Hong Kong. This yuan-pegged stablecoin carries Kazakhstan’s Astana Financial Services Authority license, which makes it the first regulated offshore Chinese yuan digital asset right now.

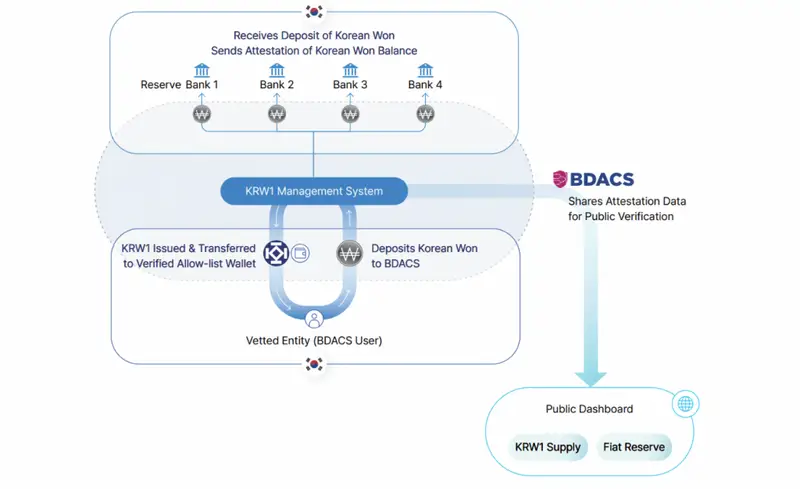

AnchorX operates the axCNH stablecoin as an overcollateralized token, and custodians back it 1:1 with fiat deposits or government debt instruments. Along with South Korea’s KRW1 stablecoin that BDACS launched, both KRW1 and axCNH function as overcollateralized stablecoins, meaning that custodians fully back them 1:1 with fiat currency deposits or government debt instruments.

An AnchorX representative is convinced about the fact that:

“AxCNH brings the Chinese yuan into the global digital landscape.”

Also Read: China Launches Digital Counteroffensive Against Dollar-Backed Stablecoins

Strategic Partnerships and Market Implementation

AnchorX signed Memorandums of Understanding with Zoomlion, Lenovo, China Brilliant Global, ATAIX, and Conflux to explore the axCNH stablecoin applications. Zoomlion successfully tested axCNH transactions on Conflux blockchain, which streamlines cross-border payments with Belt and Road Initiative partners.

The yuan-pegged stablecoin trades on ATAIX Eurasia in axCNH:KZT and also axCNH:USDT pairs. This digital yuan adoption strategy positions China to challenge dollar-backed stablecoins while also supporting international yuan usage.

Anton Kobyakov, adviser to Russian President Vladimir Putin, stated:

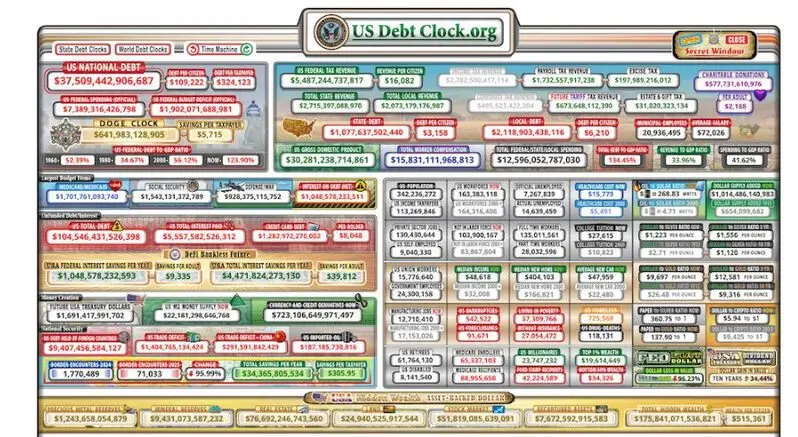

“The US government is attempting to offset its $37 trillion debt with stablecoins and gold to boost confidence in the declining US dollar.”

The axCNH stablecoin will save a settlement cost of more than 30 percent of that of classic banking, and allow quicker international payment. As the global stablecoin market is about to reach a $300 billion value, this yuan-pegged stablecoin is a strategic step that China is taking to adopt digital yuan and break the U.S. financial supremacy.

Also Read: China’s PBoC Adds $253B in Gold as Stablecoins Challenge Dollar Rule