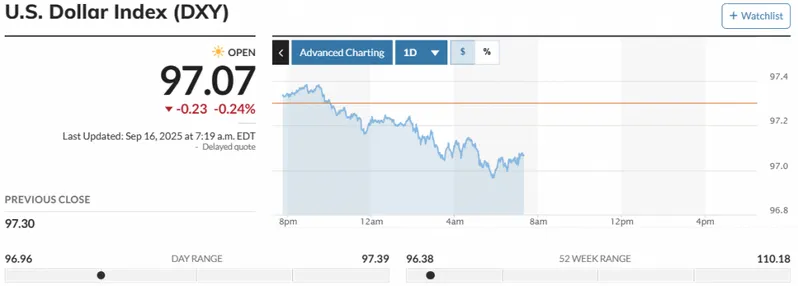

The US dollar is currently encountering waves of new troubles and issues at hand. For instance, the US government tariff ordeal had already weakened the dollar to its core. Now with the newest Fed rate cut speculations, the US dollar index has hit an all-time low of 97, holding its ground just above the collapsible pressure.

Also Read: XRP Falls 3.8% Ahead Of Federal Reserve Meeting: What’s Next?

USD Index Sways Violently Over Fed Interest Rate Cut Dynamics

The Federal Reserve is speculated to announce new rate cuts. These rate cuts are mentioned in plural, translating to the fact that odds are pointing towards more than one rate cut scenario that can unravel this year. Per a recent Reuters report, the latest survey conducted by the platform shared how experts are expecting three rate cut scenarios to be announced at max, with two to be scheduled for announcement this year. These buildable speculations are taking a heavy toll on the USD and the US dollar-backed assets, which have noted a significant new low, with the USD index sitting at 97 at press time.

“Focus remains on the Fed meeting on Wednesday. Key would be Powell’s tone.” Said Mohit Kumar, strategist at Jefferies.

At the same time, US President Donald Trump is pressuring the Fed chair, Jerome Powell, to announce a bigger cut, putting the dollar in further jeopardy.

“’Too Late’ MUST CUT INTEREST RATES, NOW, AND BIGGER THAN HE HAD IN MIND. HOUSING WILL SOAR!!!” Trump wrote, referring to Powell.

Alternate Assets Soar On USD’s Debasement

While the US dollar index tanks and hits new lows, alternative assets such as gold, silver, and BTC are all poised to gain strategically ahead. Bitcoin may end up securing a new price high in the process, breaking past its $115K ceiling.

Moreover, per Rashad Hajiyev, gold may also explore new breakout points, eyeing $3700 in the near future.

Spot gold is about to knock knock on $3,700…

— Rashad Hajiyev (@hajiyev_rashad) September 16, 2025

As far as silver is concerned, Hajiyev expects the metal to hit $50 by next week.

Spot gold is about to knock knock on $3,700…

— Rashad Hajiyev (@hajiyev_rashad) September 16, 2025

Also Read: From Burns to Shibarium: 4 Reasons SHIB May Boom by 2026