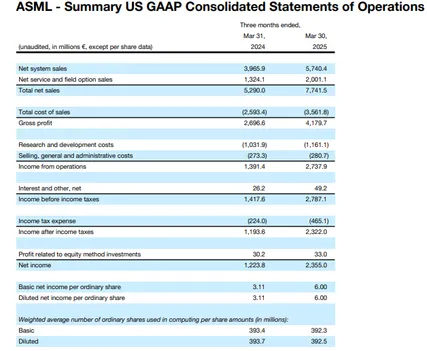

ASML’s AI chip monopoly reaches unprecedented levels, and right now the Dutch semiconductor equipment giant reported €7.74 billion in net sales for Q1 2025, which marks a 46% increase year-over-year. The company’s EUV lithography dominance positions it to capture €60 billion in annual revenue by controlling 100% of advanced AI chip production globally, and semiconductor market trends show no viable alternatives to ASML’s cutting-edge technology. ASML revenue forecast projects €30-35 billion for 2025, also setting the stage for complete AI chip supply chain control.

Also Read: 24/7 Wall St Top AI Chip Stocks to Watch for 3,100% Nvidia Gains

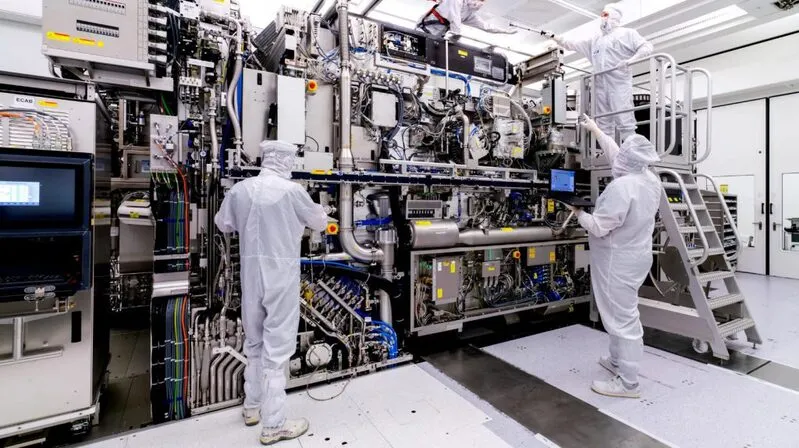

How ASML’s EUV Power Controls The AI Chip Supply Chain

The AI chip supply chain has become entirely dependent on ASML’s extreme ultraviolet lithography machines, and the company achieved a 54% gross margin in Q1 2025. ASML AI chip monopoly strengthened as net bookings reached €3.9 billion, which includes €1.2 billion from EUV systems alone. The semiconductor market trends reveal that every advanced AI processor requires ASML’s EUV lithography dominance to manufacture chips below 7 nanometers, and this creates an incredible bottleneck.

ASML CEO Christophe Fouquet stated:

“Artificial intelligence continues to be the primary growth driver in our industry. It has created a shift in the market dynamics that benefits some customers more than others, contributing to both upside potential and downside risks.”

Complete Market Control Through Technology Monopoly

ASML’s AI chip supply chain control extends beyond just manufacturing – the company shipped its fifth High-NA system to customers, which further cements its EUV lithography dominance. With 73 new lithography systems delivered in Q1 2025, and also considering the strong demand, ASML revenue forecast remains bullish as demand for AI-capable semiconductors skyrockets. The ASML AI chip monopoly creates an essential bottleneck where every major chipmaker must rely on Dutch technology, and at the time of writing, no alternatives exist.

Fouquet also said:

“Our conversations so far with customers support our expectation that 2025 and 2026 will be growth years.”

Financial Performance Drives €60B Revenue Target

ASML’s path to €60 billion annual revenue becomes clear through its exceptional financial performance, and net income reached €2.36 billion in Q1 2025. The semiconductor market trends favor ASML’s position as the sole provider of EUV systems, which creates pricing power that drives margins above 50%. This AI chip supply chain dominance allows ASML to project revenues between €30-35 billion for 2025, and the EUV lithography dominance is expected to expand further.

The company’s ASML AI chip monopoly reaches new heights as it controls every aspect of advanced semiconductor manufacturing, and right now this control is absolute. With semiconductor market trends pointing toward increased AI adoption, and also considering the lack of competition, ASML revenue forecast indicates sustainable growth toward the €60 billion target. The AI chip supply chain remains entirely dependent on ASML’s EUV lithography dominance, which makes the company indispensable for future technology advancement.

Also Read: PLTR Stock: $5K Investment Could Double as Analysts Target $155