The de-dollarization narrative has gained global recognition, with nations actively calling out to promote local currency narratives. This new perspective is leading the US dollar to note a significant valuation dip, with countries looking forward to finding able USD alternatives. The constant weaponization of the US dollar alongside its nation’s spiking debt metrics has compelled nations to make the call and contemplate hard on whether they want to support the dollar or not. With Trump taking over the US, his policies of imposing taxes on nations moving away from the dollar are also stressing the greenback. Will his leadership accelerate the de-dollarization drive or curb it entirely? Let’s find out.

Also Read: Pepe December Forecast: How High Can The Token Surge Next Month?

Trump’s New Policies: A Boon Or A Curse in Disguise?

Donald Trump has vowed to rejuvenate the greenback. The president-elect has introduced a new policy of imposing tariffs on nations that are moving away from the dollar. In one of his electoral interviews, Trump vowed to protect the greenback by keeping its integrity intact.

“Many countries are leaving the dollar. They are not going to leave the dollar with me. I’ll say, you leave the dollar; you’re not doing business with the United States. Because we’re going to put a 100% tariff on your goods,” Trump stated.

However, in recent years, several nations have echoed calls to ditch the US dollar. The narrative has been primarily fanned by the US dollar’s constant weaponization and the fact that the local currency narrative is now gaining momentum within the majority of the nations. Alliances like BRICS and ASEAN have displayed a strict stance, propagating the local currency narrative in their bilateral trade. Recently, Iran and Russia have decided to dump the US dollar for trade, opting for local currencies to conduct transactions on a broader scale.

Dollar Dump On The Rise?

As Trump ascends to the presidential role, the president-elect is committed to reviving the greenback, which in turn may backfire as per several analysts.

Per Hong, a notable analyst, the taxes that Trump will impose on China will certainly spike the inflation metrics, ushering in more chaos than before.

“If you put a 100% tariff on Chinese exports. For example, one could only imagine how high the U.S. inflation is going to go. He said, adding that much of the U.S.’s trade deficit would shift to allies like Mexico and Canada. As quoted by CNBC

At the same time, this phenomenon may have its own ripple effect, compelling nations to ditch the greenback for a more supportive currency.

Also Read: Shiba Inu: You Could Have Made $1 Million With Just $10 In SHIB

AI Predicts Whether De-Dollarization Will Quicken Under Trump’s Rule

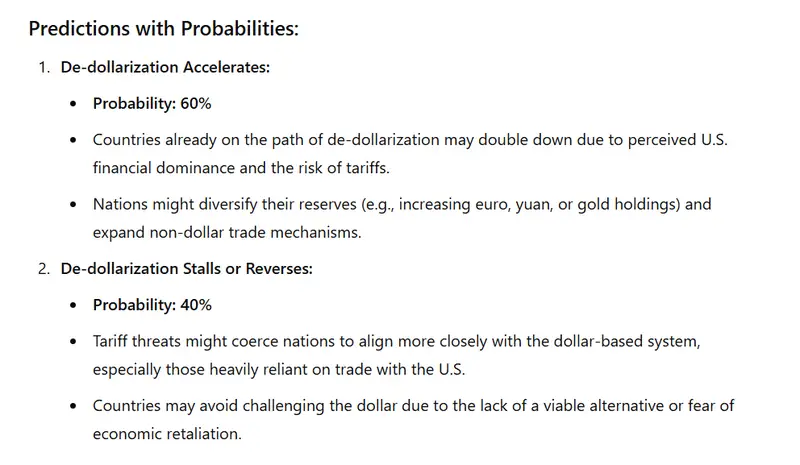

Per AI, there’s a solid 60% chance that the de-dollarization may advance under Trump’s regime. The portal weighed in factors such as his tariff policy, which may push countries further away. The concept may also compel nations to diversify their reserves in USD alternatives (gold, euro, yuan) to maintain equilibrium, spelling more trouble for the greenback.

However, the portal later shared a 40% chance of de-dollarization reversal. The platform noted that if the countries align with the US to work in sync with its policies, such narratives may fade eventually.

Also Read: Ripple: XRP Outperforms Bitcoin & Dogecoin: Will It Hit $2 Soon?