The cryptocurrency market saw a brief rally last week after the Federal Reserve announced a 25 basis point interest rate cut. However, the rally did not last long. The cryptocurrency market faced a substantial crash on Monday, Sept. 22, 2025. According to CoinGlass data, $1.7 billion worth of crypto assets faced liquidations in the last 24 hours. Despite the alarming price dip, the market could rebound soon, as the chances of another interest rate cut in October continue to rise.

Will Another Interest Rate Cut Push The Cryptocurrency Market?

The latest cryptocurrency market crash could be due to increased volatility arising from monetary policy uncertainties. The week is filled with key economic events that could shape how the market behaves over the coming weeks.

Also Read: Key Events To Watch This Week That May Affect Cryptocurrencies

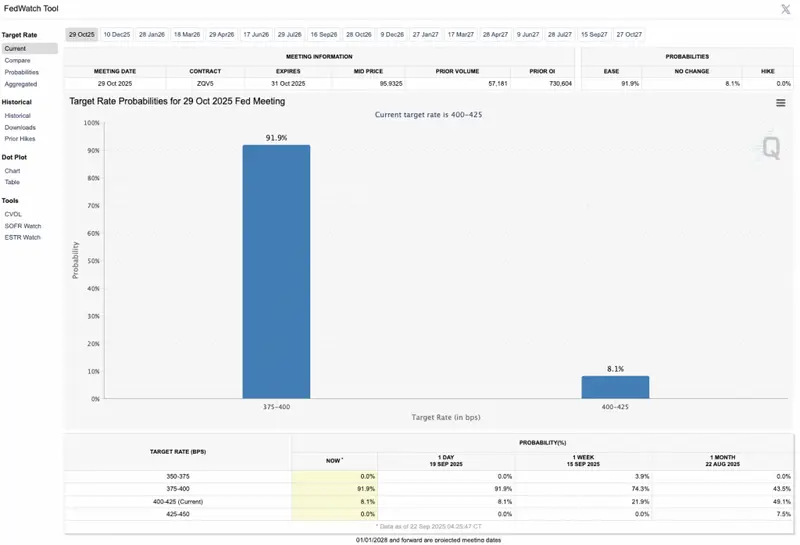

According to CME FedWatch, there is a 91.9% chance that the Federal Reserve will introduce another 25 basis point interest rate cut in October. Rate cuts have often led to market rallies as borrowing becomes easier. A similar pattern was observed last week after the Fed’s first interest rate cut in 2025. Another rate cut could lead to the cryptocurrency market entering another bull run.

Apart from the possible interest rate cut, October has historically been a bullish month for the cryptocurrency market. The pattern could continue in 2025 as well. Moreover, a dovish stance from the Federal Reserve will further boost chances of a market rally.

Bitcoin (BTC) is the market leader, and other cryptocurrencies often follow its trajectory. According to CoinCodex, BTC will recover over the coming weeks, hitting a new all-time high of $140,802 on Dec. 21, 2025. Hitting $140,802 from current price levels will entail a rally of about 25.29%.

BTC entering a bullish phase will most likely lead to other assets experiencing respective rallies as well. How the market unfolds over the coming days will most likely set the tone for the rest of the year.