Gold prices have skyrocketed through the roof, and seven countries combinedly helped push the XAU/USD index to this level. The precious metal reached a new all-time high of $4,035 on Wednesday, surging 52 points in a day, and is up 1.30%. The XAU/USD index is attracting heavy bullish sentiments from retail traders, institutional investors, and central banks of developing countries.

Among the central banks of developing countries, seven nations have helped push gold prices above the $4,000 range. They played a prominent role in its price rise by accumulating tonnes of the precious metal in their reserves. The overall purchases of these countries touched more than a billion, making the glittery metal skyrocket in value.

Also Read: Dollar Share Drops, Jobs Data Sinks: Double Trouble For America?

Countries That Brought the Most Gold to Help Prices Climb $4,000

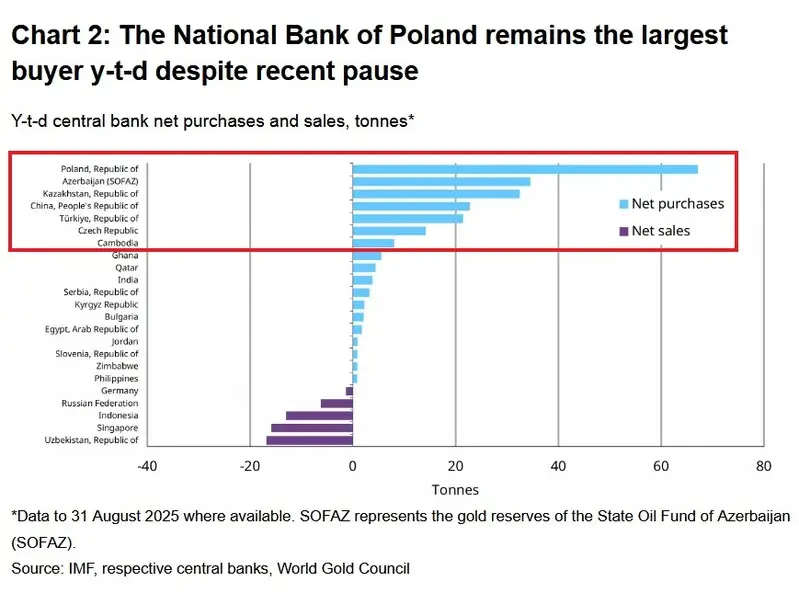

The seven countries that purchased tonnes of gold last quarter to make it go above $4,000 are:

- Poland

- Azerbaijan

- Kazakhstan

- China

- Turkey

- Czech Republic

- Cambodia

In addition, countries such as Ghana, Qatar, India, Serbia, Kyrgyz Republic, Bulgaria, Egypt, Jordan, Slovenia, Zimbabwe, and the Philippines have also accumulated tonnes of gold in their central banks that helped drive up prices.

Also Read: Uptober Threatened? Cryptocurrency Market Faces Big Correction

A handful of developing countries are accumulating the commodity and diversifying their reserves. The demand for gold is extremely strong, and it’s driving up the prices. The XAU/USD index has surged by 54% year-to-date and is among the top-performing assets. Silver and copper have also generated double-digit profits in the commodity market this year.

Traders who took entry positions in gold, silver, and copper have all made tremendous profits. All three metals are in high demand for both retail and manufacturing sectors. The entry of central banks into gold accumulation changed the direction of the XAU/USD index. Analysts say an entry position in gold now could still be profitable to investors.