The dilemma over the ongoing US elections has finally dissipated with Trump being crowned as the next US president. The former US president has left no stone unturned to promote his candidacy and has made bold promises in the process to uplift the US economy. Now that the official announcement of his presidency has been made, investors cannot help but wonder about the potential impact that Trump may emanate after reclaiming the White House.

The repercussions of this change are bound to be felt in the realm of stocks, crypto, and finance in general. After assessing the current circumstances, here are three US stock picks that may deliver good returns now that Trump has assumed the role of the president of the United States.

Also Read: AI Predicts Shiba Inu’s Price (SHIB) When US Elections Results Are Out

Three Trending US Stock Picks To Explore As Trump Assumes A Presidential Role

1. Tesla (TSLA)

Donald Trump has shown incredible support and strength to Elon Musk, the tech billionaire and the CEO of Tesla Motors. The Trump-Musk duo has aced the ultimate race of the US presidential campaigns, with Musk extending his full support towards Trump. Both Trump and Musk share similar stances on a multitude of political topics. Their combined love for crypto is globally renowned, and they can be game-changers for Tesla in general.

In addition, if Musk assumes a cabinet role now that Trump has become president of the United States, it can bode incredibly well for Tesla in the long haul. Regarding the firm’s stocks, TSLA stocks have surged to a 52-week high at press time, trending at $252 per share.

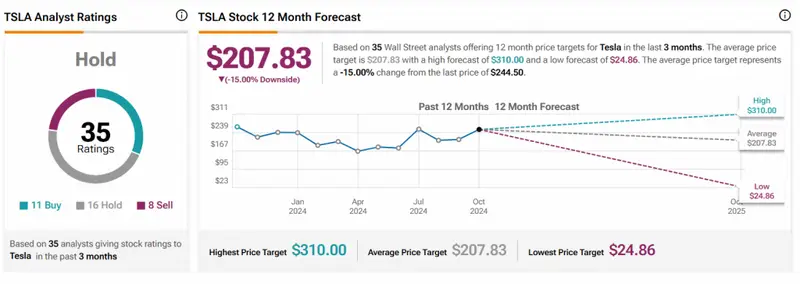

Per TipRanks, TSLA may reach its all-time high of $310 within the next 12 months. The firm is busy launching its Robotaxis, an ambitious project that could transform the firm and its stocks.

“The average price target for Tesla is $207.83. This is based on 35 Wall Street analysts 12-month price targets issued in the past 3 months. The highest analyst price target is $310.00; the lowest forecast is $24.86. The average price target represents a -17.34% decrease from the current price of $251.44.”

2. JP Morgan and Chase (JPM)

A recent Reuters report outlined how the leading bank stocks could surge dramatically if Trump became the next US president. A Republican win may “ensure improved domestic investments, looser regulations, domestic job additions, and tax cuts,” strengthening the sector.

As Musk promised, an economic overhaul is on the cards for the US as Trump takes over the White House. This overhaul is intended to protect the integrity of the nation as a whole and its financial resources. This could usher in a new era for notable bank stocks like JP Morgan and Chase.

Per TipRanks, JPM stocks may claim a new high of $257 within the next 12 months.

“The average price target for JPMorgan Chase & Co. is $234.56. This is based on 19 Wall Street Analysts’ 12-month price targets issued in the past 3 months. The highest analyst price target is $257.00, and the lowest forecast is $200.00. The average price target represents a 5.90% increase from the current price of $221.49.”

Also Read: Ripple: XRP Projected to Rise 35% After US Election Results

3. Chevron Corps (CVX)

Multiple reports also indicate Trump’s inclination towards clean energy in this wake. With Chevron Corps stocks looking forward to a major haul, energy-centric stocks may receive a major boost. The analysts at Morgan Stanley believe Trump may use his administrative powers to “reduce the regulatory burden on domestic oil and gas production while considering more restrictive trade policies.” This development may push stocks like Chevron to claim new highs soon.

Per TipRanks, CVX is aiming for a high of $194, which the firm may claim within the next 12 months.

“The average price target for Chevron Corp. is $171.31. This is based on 15 Wall Street Analysts 12-month price targets issued in the past 3 months. The highest analyst price target is $194.00, and the lowest forecast is $154.00. The average price target represents 11.67% increase from the current price of $153.41.”

Also Read: US Election Frenzy Could Send Bitcoin (BTC) To $100K, Here’s When