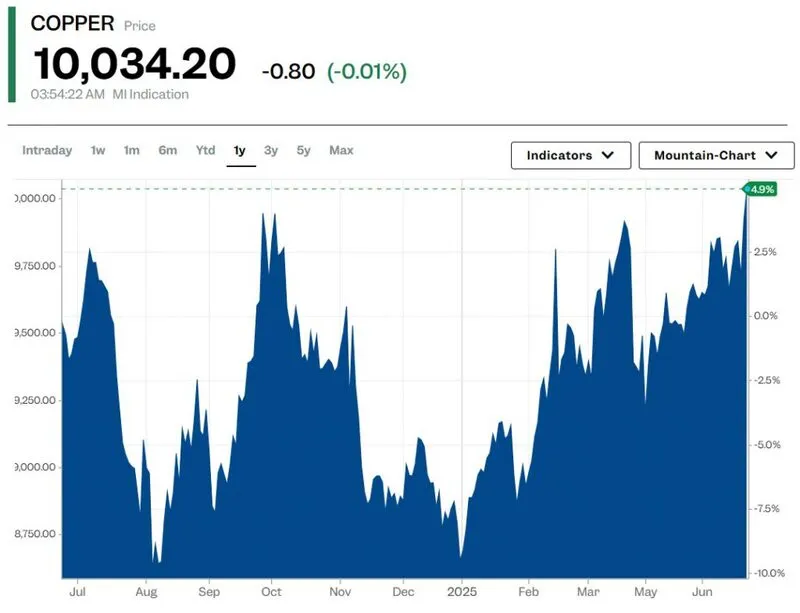

Copper prices breached the $10,000 mark on Tuesday touching a 52-week high of $10,034. The unprecedented rally came after the US decimated three of Iran’s nuclear sites that threatened world war 3. This led to US-based copper stocks trading in the green on Monday delivering decent profits to day-traders.

In the aftermath of the strikes, Iran launched missiles on US bases in Qatar but were successfully intercepted. The war hunger is what made copper prices surge as the commodity is used for weapons and ammunition manufacturing. Now that a ceasefire has been announced, we will highlight the top 3 copper stocks to watch out for if the truce is suspended.

Also Read: Tesla Stock (TSLA) Up 10% After Robotaxi Launch: $400 Incoming?

Copper Stocks To Watch Out For Next

The three US-based copper stocks to watch out for in the NYSE markets are:

1. Freeport-McMoRan (FCX)

2. Teck Resources TECK)

3. Southern Copper Corp (SCCO)

All three firms deal with copper production and distribution and the stocks spiked nearly 2% on Monday. Dow Jones surged nearly 375 points despite the global uncertainty which tanked the Asian markets on Monday’s trading session.

Also Read: Robotaxis Roll Out in Austin: Is Tesla Stock Ready to Climb?

If the ceasefire is broken, the chances of these three US copper stocks to surge in value remain high. Tensions in the Middle East rarely settle down and could get dragged on for months, if not years. While the initial fight was with Israel and Palestine, Iran got involved in the conflict. The US dragged itself into the turmoil making it a Israel-Palestine-Iran-US scuffle.

In addition, Qatar announced on Monday that it would retaliate against Iran for launching missiles into their country. While the conflict is now being forcefully stopped by the ceasefire, chances remain that it could continue. If the war escalates, copper firms will benefit the most as the metal is used for the offensive stance. Therefore, the NYSE-based copper stocks must remain on your watchlist if the conflict escalates.